VIDEO UPDATE: Video | Facebook TODAY’S RATES & HOUSING NEWS Mortgage Interest Rates went up…

🏡 Interest Rates Rise .2% Before FED Meeting

VIDEO UPDATE:

Mortgages Rates Move Up .2% before the Fed Meeting, Get Cozy by the Fireplace 🔥 Here is Your Weekly Mortgage Rate Update 📊

TODAY’S RATES & HOUSING NEWS

Mortgage Interest Rates moved up .2%

over the past 7 days with the Mortgage

Backed Security Market (MBS) trading

down -64 bps. The 10 Year US

Treasury is currently at 4.4007%.

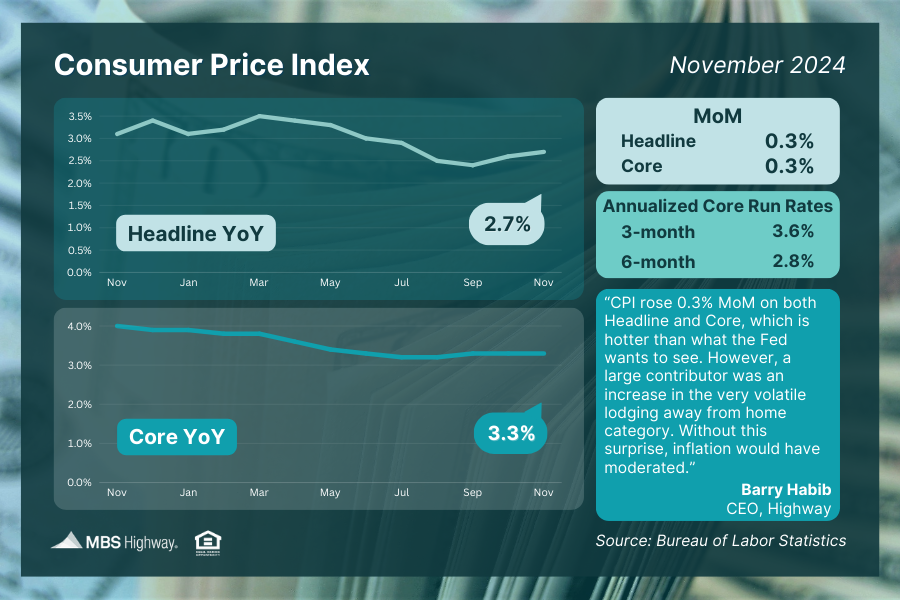

The 2 big market movers last week

were the PPI – Producer Price Index

which measures inflation for wholesale

producers and the CPI – consumer

price index which measures inflation

for consumers.

Both inflation gauges went up.

PPI went from 2.6% to 3%.

CPI went from 2.6% to 2.7%.

The FED is meeting on Wednesday

and the market is expecting a 25

bps cut. Of more importance to

interest rates will be the FED’s

long term predictions on the

economy and rate cuts.

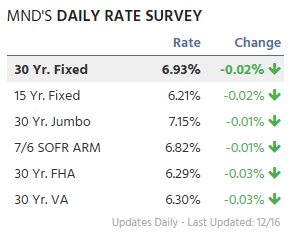

Below are Mortgage News Daily’s

average interest rates across the country.

There are a lot of characteristics that

go into a mortgage rate – credit score,

investor, loan to value, loan amount,

costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

HOW TO PREPARE FOR EARLY YEAR

AND SPRING HOME BUYING SEASON

1. Check Your Financial Health

*Credit Score: A higher score means

better mortgage rates. Fix any errors

on your report.

*Save for Costs: Budget for a down

payment (3%-20%) and closing

costs (2%-5%).

*Debt-to-Income Ratio: Keep it

below 43% to improve mortgage

eligibility.

2. Get Pre-Approved for a Mortgage

A pre-approval shows sellers you’re

serious and helps define your budget.

Gather income proof, bank statements,

and credit history for this step.

3. Work with a Real Estate Agent

An experienced agent can:

*Share insights on local trends

*Help you act fast on new listings

*Negotiate effectively on your behalf

4. Know What You Want

Make a list of your priorities:

*Location, home size, and

must-have features

*Stay flexible to increase your options

5. Start Watching the Market Early

Set alerts for listings and monitor

local trends. Consider starting your

search in late winter to beat the

spring rush.

6. Be Ready to Move Quickly

In a competitive market, homes sell

fast. Have your documents and financing

ready, and work closely with your agent

to make strong offers.

DECEMBER REAL ESTATE MARKET REPORT

Here is the audio of Keeping Current

Matter’s December Monthly Market

Report:

Here are some of my favorite slides.

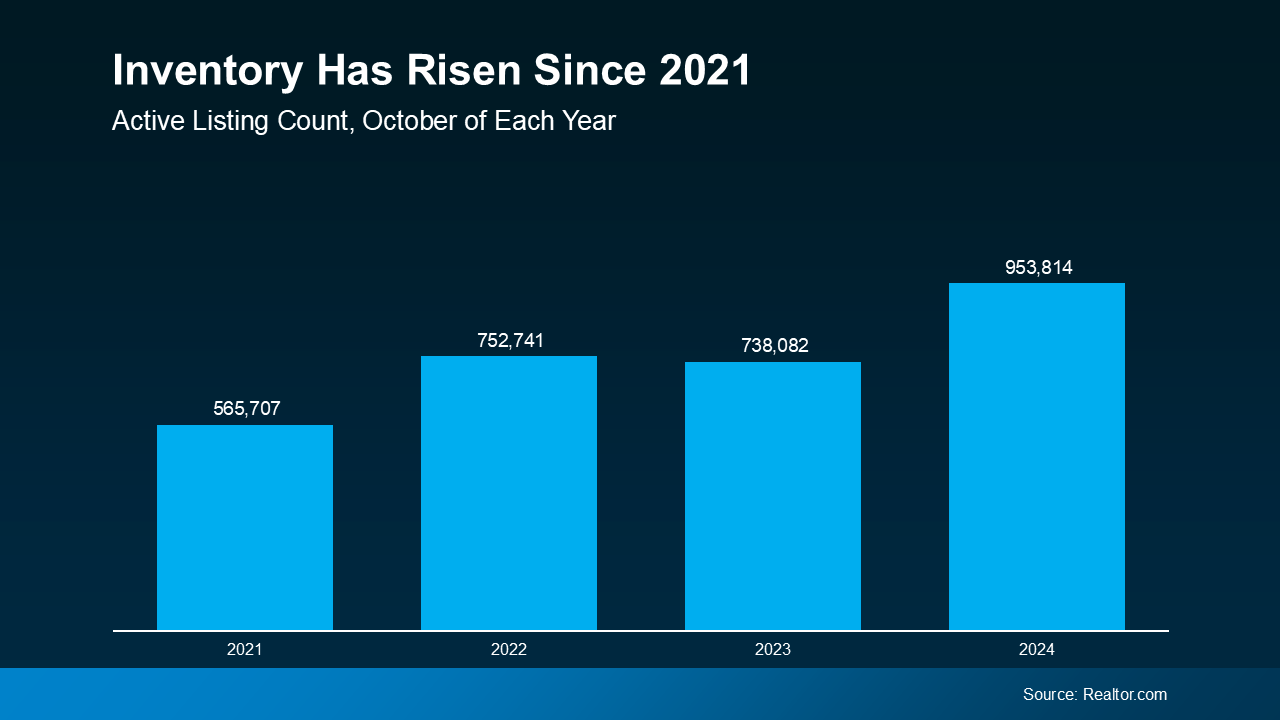

Inventory and Days on Market is

rising since 2021.

Many experts believe inventory is near

the top levels it will go unless rates drop

below 6%. Many existing homeowners are

weary to sell their existing home unless

they can get a rate on a new home below 6%.

The market is expecting modest declines

in mortgage rates in 2025, but they expect

the housing inventory to remain tight.

Here are where the experts predict

mortgage rates to head in 2025.

HAVE A GREAT WEEK!!