VIDEO UPDATE: Tariff Hysteria and Up and Down Interest Rates, Here’s Your Weekly Mortgage Rate…

📊 Rates Are Up, But So Are Real Estate Opportunities—Here’s Why

VIDEO UPDATE:

Mortgage Interest Rates Rise to Highest Levels Since July. Here is Your Mortgage Rate Update

TODAY’S RATES & HOUSING NEWS

Interest rates have moved up over .2%

over the past 7 days with the Mortgage

Backed Security (MBS) market trading

down -69 bps. The 10 Year US Treasury

is trading at 4.175%.

The biggest jump came on Monday with

the MBS Market trading down -53 bps.

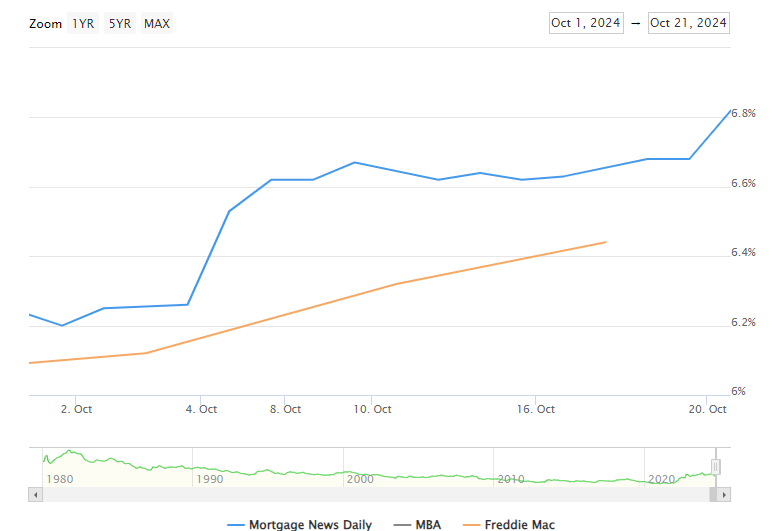

October 2024, just like October 2023

has been scary for mortgage interest

rates. Here is where interest rates

have moved since the beginning of

October (the blue line is most

accurate).

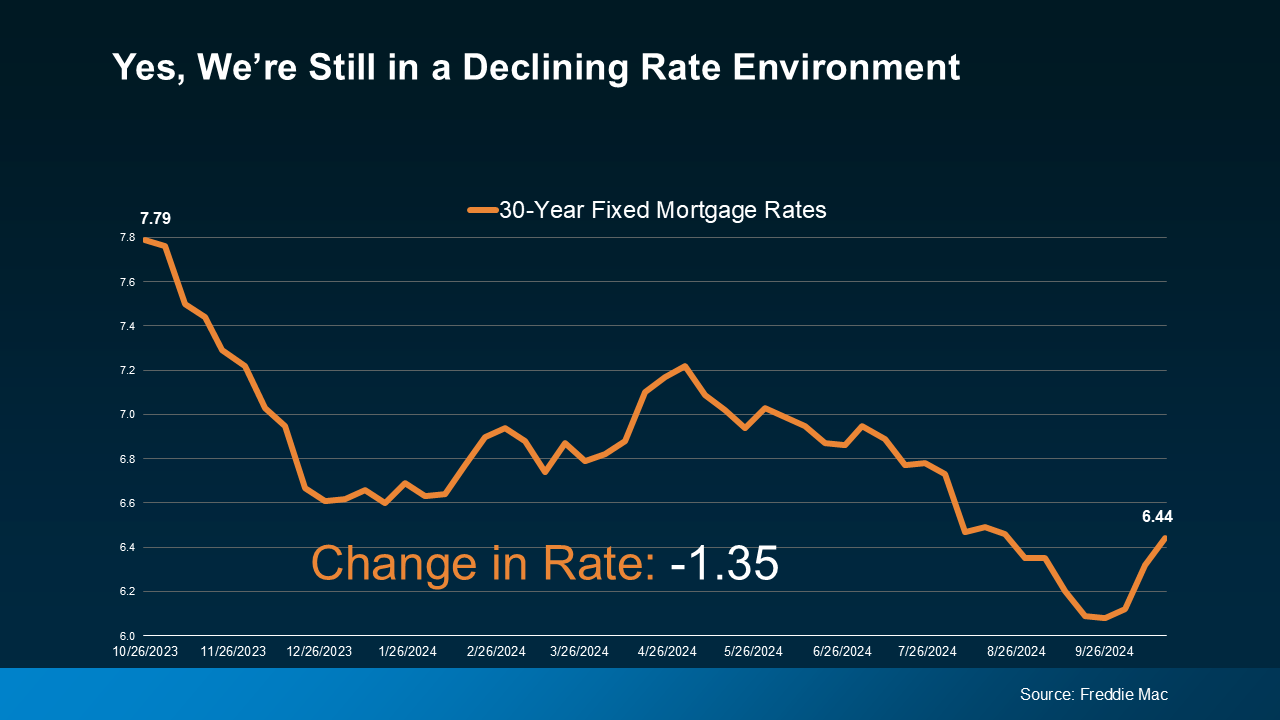

In October 2023, Mortgage Interest Rates

also made a large jump and tumbled down

in November and December 2023.

Let’s hope for the same action again.

One thing about the rate environment

is that rates typically move in a

direction over time, but there are a lot

of bumps and valleys on the way.

Mortgage interest rates were at 7.79%

in October of 2023. Even with the

recent rise in rates, we are still well

below that figure.

The BLS Jobs Reports on November

1st, and the FED Meeting on

November 7th will be important events

that effect where interest rates go

for the rest of 2024.

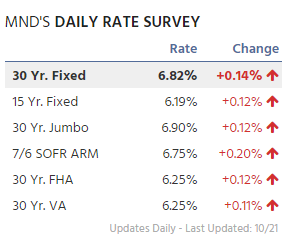

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your

specific scenario so we can

price your loan out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

FINDING OPPORTUNITIES

DURING DIFFICULTY

If you talk to most consumers and

professionals in mortgage or real estate,

there is frustration at mortgage interest

rates going up after the FED lowered the

Federal Funds Rate.

One thing I always look for is where is

the opportunity in the current challenging

environment. There are always opportunities.

If I look at the current housing

environment here is what I see:

-Interest Rates have went up significantly

which will cause less demand to

purchase homes.

-There is less demand to purchase

homes during the Holiday Season.

-Supply has risen in most areas of

the country – more supply causes

lower prices.

Both demand and supply metrics are

moving in the direction where consumers

can get better deals both in price and

terms on their purchase.

And the terms are just as important

if not more important than price.

If the current market allows my

realtor to negotiate 1% more seller

concessions to purchase a home,

I’m able to buy down my rate .5%

with the seller paying for it.

If you talk to almost any seasoned real

estate investor, they will tell you that

money in real estate is made on the

buy. When all market conditions give

a buyer higher negotiating power, there

will be some outstanding opportunities

to purchase Real Estate at a below

market price.

Robert Kiyosaki – “Profits are made in

the buying, not the selling. Real estate is

an investment that takes time to pay off.”

Have a great week!