VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

🎉 The Fed Finally Lowers Rates – Here’s What It Means for You!

VIDEO UPDATE:

The FED Finally Lowers Interest Rates. Here is Your Weekly Mortgage Interest Rate Update! (youtube.com)

TODAY’S RATES & HOUSING NEWS:

The FED finally does it!

After over 4.5 years, the FED

lowered the Federal Funds Rate

50 bps on September 18th. The

FED also predicted that they would

lower the Federal Funds Rate another

50 bps through 2024, and another

100 bps through 2025.

Here is a brief history of the recent

Federal Funds rate rise.

Inflation started skyrocketing in 2022

and the FED combatted that by

raising the Federal Funds Rate

to try and tame inflation. By

increasing the cost to borrow, it

is less likely people would purchase

as much. Lower demand helps keep

prices stable.

So what does the FED lowering the

Federal Funds Rate mean for you?

The Federal Funds rate is the overnight

banking rate that banks lend to one

another. The Federal funds rate has a

direct impact on short term rates such as:

Credit Cards

Car Loans

Personal and Business Loan

And Short-Term Treasuries

While the Federal Funds Rate can

impact mortgage rates over time, it is

not directly tied to mortgage rates.

Mortgage rates are more closely tied

to inflation.

As inflation comes down, mortgage rates

typically follow. As inflation rises,

mortgage rates typically rise.

The FED lowering the Federal Funds

Rate can actually increase inflation as

it allows people to borrow and spend

more. The theory is that the FED has

been restrictive on short term rates for

so long, that lowering the Federal

Funds Rate and Short Term Rates

shouldn’t impact inflation and cause

it to rise. This is the so called

“soft landing” the FED was looking

to achieve.

You can see this indirect correlation

with what happened to mortgage rates

this week. The market predicted that

the FED would lower the Federal Funds

Rate by at least 25 bps for 2 months.

When the FED finally did lower the

Federal Funds Rate on Wednesday –

mortgage interest rates did a peculiar

thing. Mortgage Rates actually went up.

Mortgage Rates went up approximately

.1% over the past 7 days with the

Mortgage Backed Security (MBS) market

trading down -20 bps.

I believe that the FED lowering the

Federal Funds Rate over time will

help lower mortgage rates over time.

This typically takes much longer than

we expect and doesn’t happen in a

straight line – meaning rates will go

down and up, but more movement

down over time causes interest rates

to slowly decline.

I’ll break down how I would look at

interest rates and buying and refinance

decisions below.

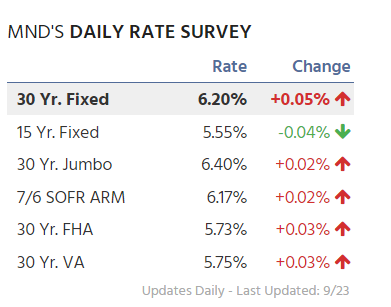

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

SHOULD I WAIT FOR RATES TO DROP?

This is a very common question we

get, especially when rates are

expected to move lower. If rates are

going to move lower, why would I

refinance now or purchase today

when I could just wait until rates

are lower.

Here is a breakdown of the potential

benefits and drawbacks of waiting.

Let’s start with Refinancing.

REFINANCE – SHOULD I

REFINANCE OR WAIT?

If you refinance today and rates

continue to move lower, you could

decide to refinance again which could

equate to you paying refinance fees

more than once and going through a

loan process more than once.

The benefits of waiting could be:

* As rate falls you will save more

money on your rate and payment.

*Waiting could cost you less in fees

by eliminating multiple refinances

*Could save you time by not going through

the loan process more than once

The drawbacks of waiting could be:

*Paying a higher interest rate and payment

today while you are waiting for more

savings in the future

*There is absolutely no guarantee that rates

will continue to drop and you could lose an

opportunity to save money

*Rates typically take longer to drop than

people realize, thus costing you money

while you wait

Here is my recommendation when refinancing:

If you can save a good amount of interest

and lower your payment a good amount

today (that is different for people based

on their income and budget) and you can

recoup your costs in less than 2 years,

I would consider refinancing.

For example, let’s say I can save $150 per

month and it costs me $3,500 in costs to do it.

(DO NOT INCLUDE PREPAID INTEREST

AND ESCROW IMPOUNDS IN COSTS AS

THEY ARE NOT REAL COSTS)

$3,500 divided by $150 =

23.33 month recoup period.

I would likely do that because the

recoup period is less than 2 years

and I know there is no guarantee

interest rates will fall or how fast

they will fall.

Let’s say I do the deal above, but

I end up refinancing again in one year.

I save $150 x 12 = $1,800. The

original loan cost me $3,500, so

I lost $1,700. To me that $1,700

loss was worth me potentially losing

$150 per month for the length of my loan.

You have to make your own judgement

call on what’s most important to you.

Saving money today or waiting to save

more money tomorrow without a

guarantee that you can save more money.

HOME PURCHASE – SHOULD

I PURCHASE OR WAIT

If you purchase today and rates continue

to move lower, you could decide to

refinance in the future which could

equate to you paying loan fees more

than once and going through a loan

process more than once. But, if rates

drop, this usually creates more housing

demand which leads to higher home prices.

The benefits of waiting would be

close to the same:

*As rate falls you will secure a home

with a more affordable rate and payment

*Waiting could cost you less in fees by

eliminating multiple home loans

*Could save you time by not going through

the loan process more than once

The drawbacks of waiting are quite different:

*If rates drop significantly, home

prices will likely rise

*A rise in home prices will increase

your down payment requirement

*Despite a lower rate, your payment could be

higher because the purchase price and loan

amount are higher.

Let’s do a simple example.

Let’s say I have the opportunity

to purchase a $400,000 home today.

I buy a $400,000 home today putting

20% down and finance the rate at 6.25%.

This would look like this:

$1,970.30 Principal and Interest Payment

$320,000 Loan Amount

$80,000 Down Payment + Costs and Prepaids

Let’s compare this to waiting a year and

purchasing a home at 5.75%.

If the home appreciates at 5%, purchase

price in a year would be $420,000.

This would look like this:

$1,960.80 Principal and Interest Payment

$336,000 Loan Amount

$84,000 Down Payment + Costs and Prepaids

So, in the above example, you save

$10 per month in the monthly payment

by waiting one year, but you pay a

higher purchase price of $20,000.

You would not make up that $20,000 in

your monthly cash flow during the full

life span of a 30-year mortgage.

Again, this is a personal decision

for you but if I know I’m going to

purchase a primary residence, I

would rather purchase now because

I can secure the home at today’s

prices and refinance in the future if

rates drop to lower my rate and payment.

Have a great week!