VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

🏅 Secure Your Savings: How to Be Refinance-Ready When Rates Drop

Mortgage Rate Update, August 13th, 2024 (youtube.com)

TODAY’S RATES & HOUSING NEWS

After hitting 14-month lows on Monday,

August 5th, interest rates moved up

some with the Mortgage Backed

Security (MBS) market trading down –

29 bps over the past 7 days.

This past week shows a trend that

we often see when interest rates drop.

When rates drop, rates typically hit

a low for 1-2 days and then the market

has a correction day and we lose some

of the gains.

While it’s difficult to take advantage

of this short period of time on purchase

loans as they depend on when you go

under contract, you can take advantage

of this on refinances.

The key is to be ready when rates drop

so we can lock your loan quickly.

My suggestion is to have an open

refinance application and have a target

rate price that makes it worth it for

you to refinance. By preparing now,

when rates drop we can quickly take

action and secure your rate. We typically

only have 1-2 days to take advantage

of the bottom of the market.

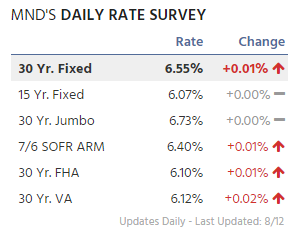

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

JULY 2024 REAL ESTATE

MARKET REPORT

Here is the Audio of Keeping Curren

t Matter’s July 2024 Real Estate

Market Report:

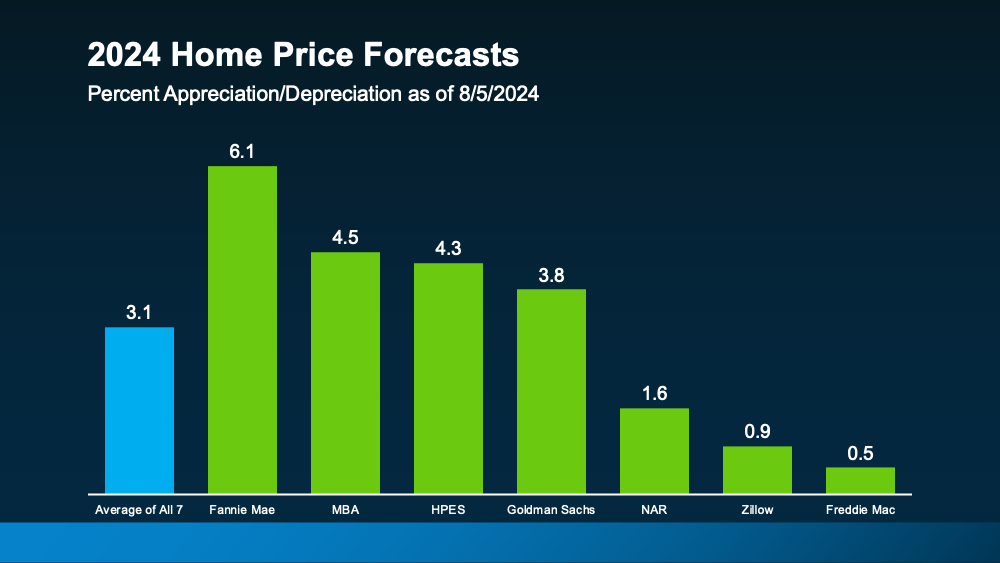

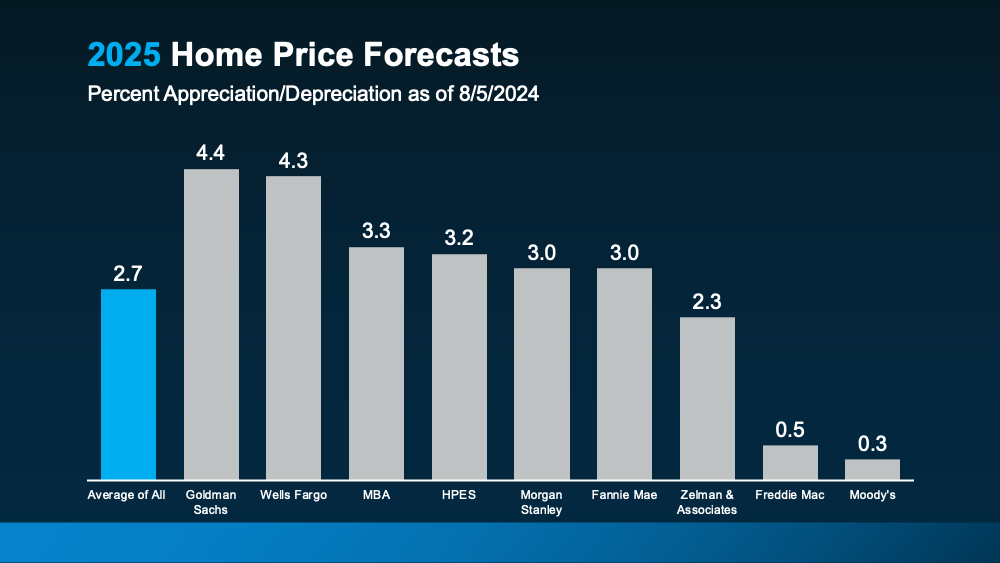

Here are some of my favorite slides

from the July Report:

1.) We will have stronger housing demand

as interest rates go below 6.5%.

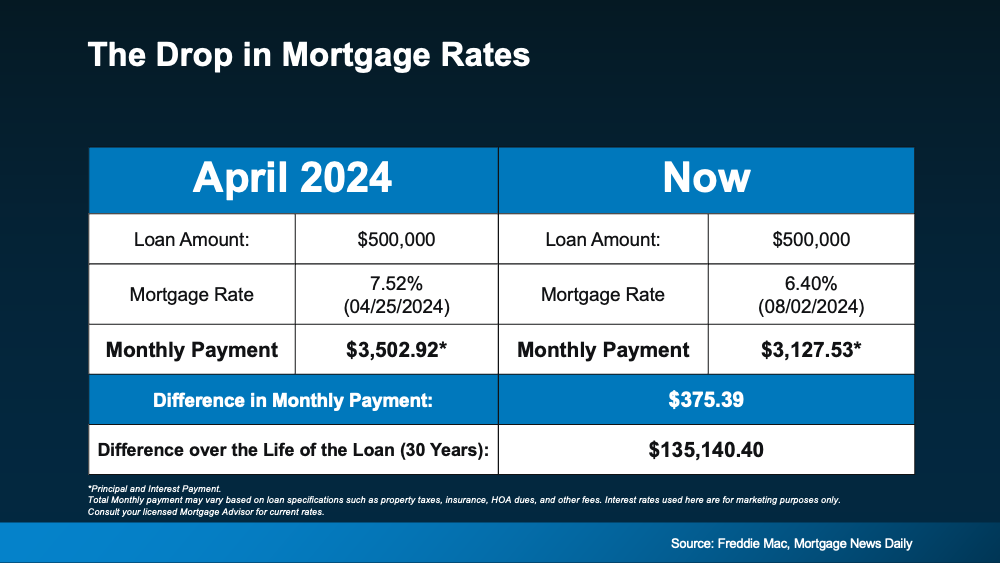

2.) How Your Mortgage Payment would

compare from April to Today:

3.) Here are where we expect Home

Prices to go for the rest of 2024

and 2025.

**

Have a great week!