VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

🏡 Election Aftermath: What’s Next for Interest Rates & Housing?

VIDEO UPDATE:

Election Aftermath: What’s Next for Interest Rates?

TODAY’S RATES & HOUSING NEWS

The election is over and we now

must digest what this means for

Mortgage Interest Rates moving

forward.

On Wednesday morning, it looked

like we could see rates soar

higher as stocks went up.

When stocks go up, it usually

has a negative effect on

interest rates.

While interest rates went up

some on Wednesday, since then

interest rates have moved down.

Over the past 7 days, mortgage

interest rates improved about

.15%, with the Mortgage Backed

Security (MBS) Market trading up

+79 bps. The 10 Year US

Treasury currently sits at 4.33%.

Outside of the election, we also

saw the FED lower the Federal

Funds Rate 25 bps. The FED

is now playing a balancing act

as it wants to continue a monetary

policy that will get inflation to

2%, while also supporting a softening

labor market.

FED futures are currently predicting

a 70% chance that the FED lowers

the Federal Funds Rate 25 bps at

their final meeting of the year in

December 2024.

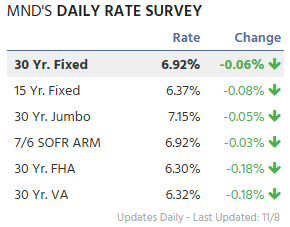

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your

specific scenario so we can

price your loan out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

NOVEMBER REAL ESTATE REPORT

Here is the audio of Keeping

Current Matters November 2024’s

Market Report:

The expectation is for mortgage rates

to stabilize after the election.

And for interest rates to go

down in 2025.

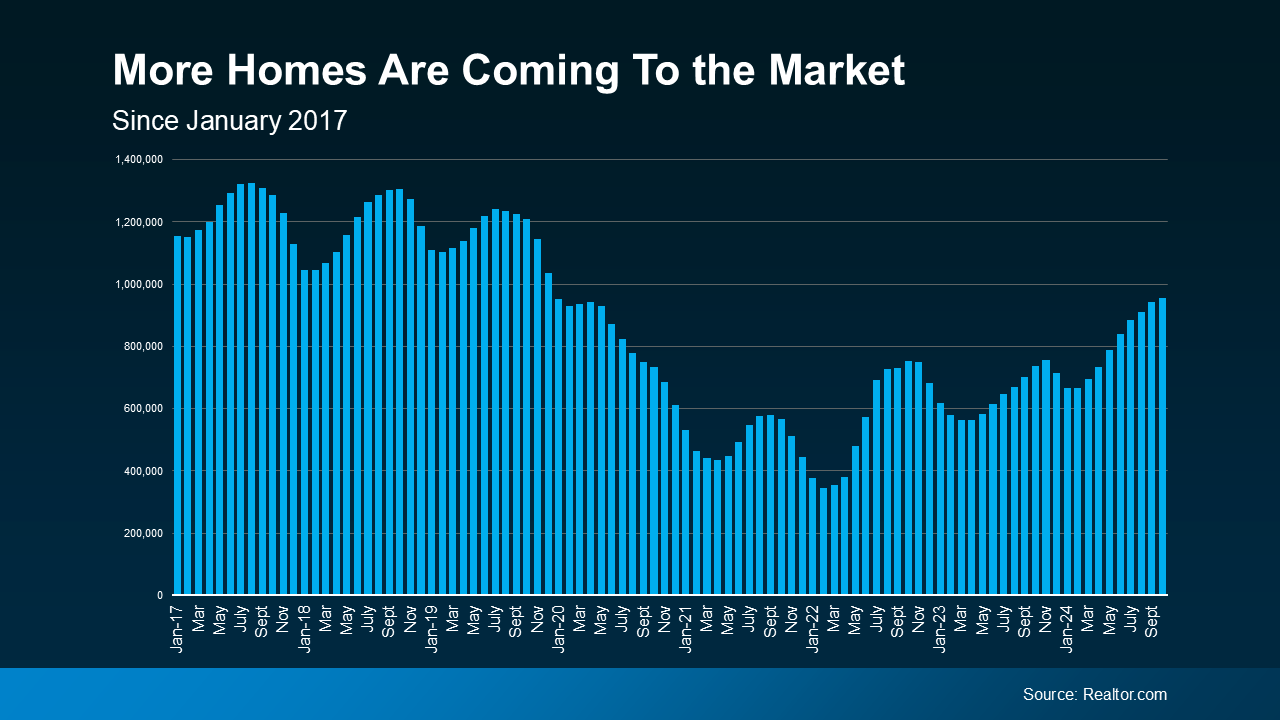

More housing inventory has been coming

on the market which is stabilizing pricing

while giving the homebuyer more options.

Many consumers believe that the housing

market could crash after great appreciation

over the past 4 years. The reason KCM

doesn’t expect that to happen is because

builders have underbuilt over the past 15

years, not keeping pace with family creation.

Even with inventory going up, there

is still not enough homes in the U.S. for

families that want to purchase a home.

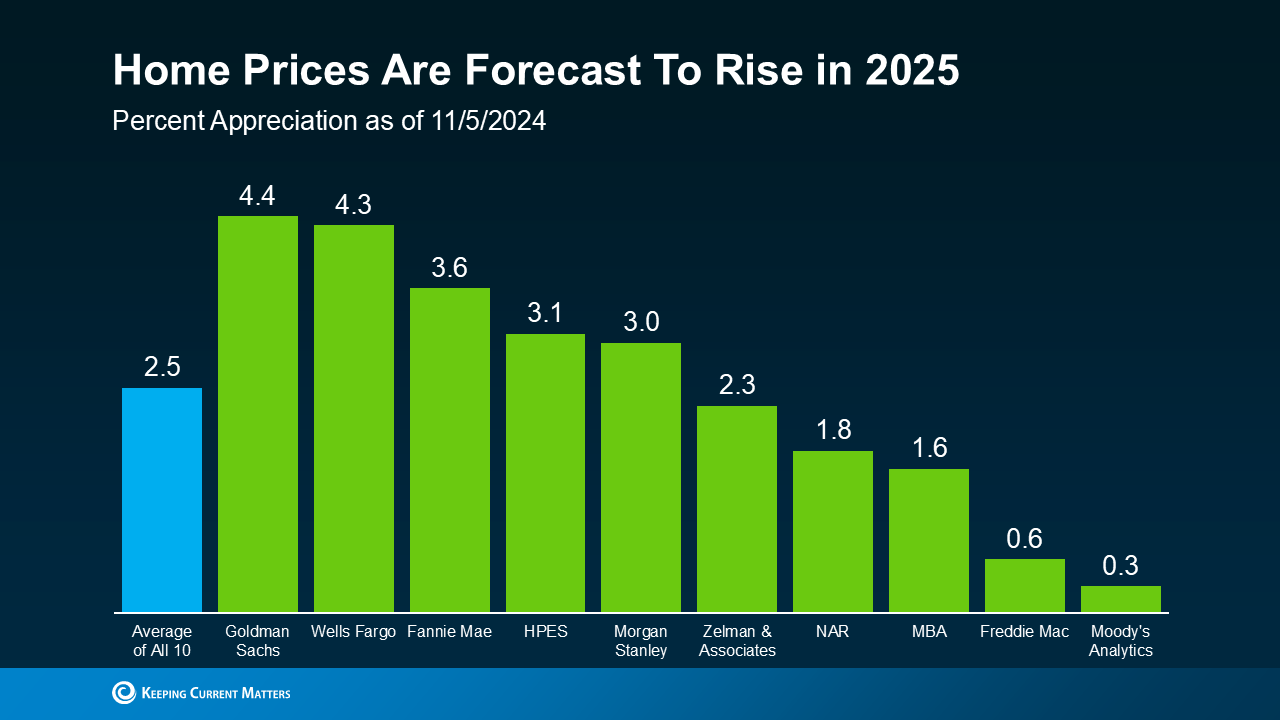

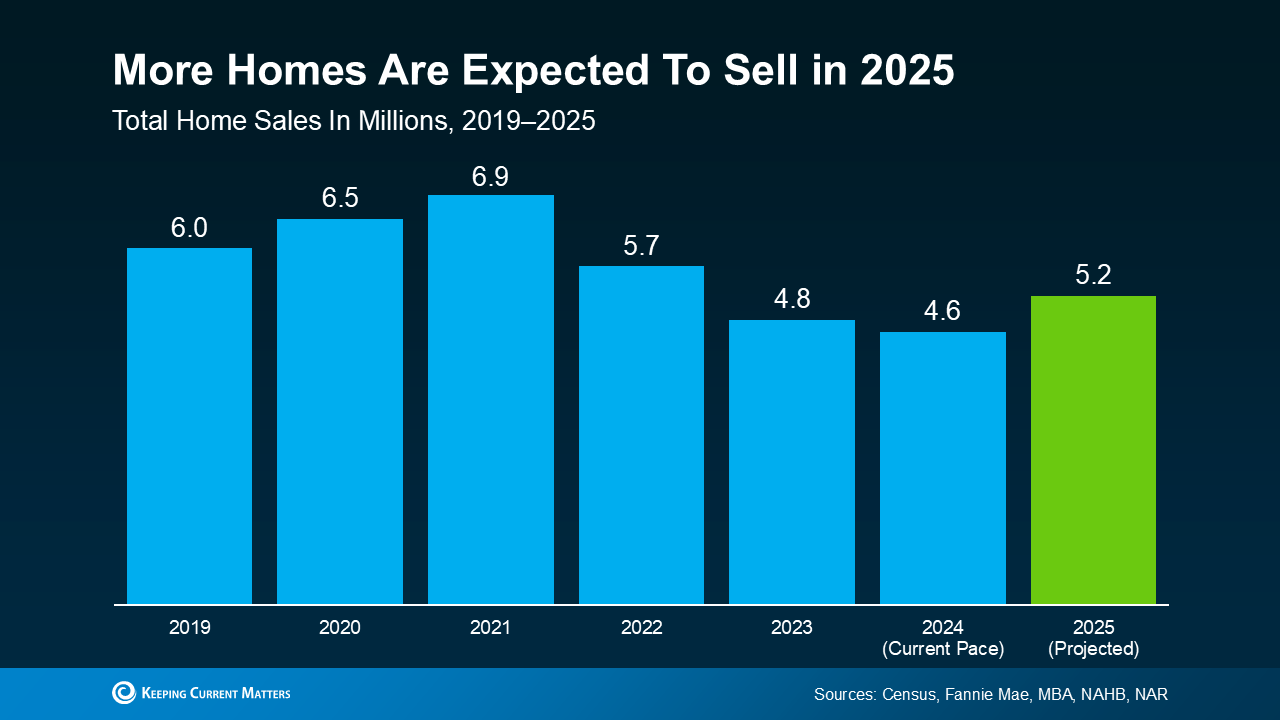

Home prices are expected to moderately

increase in 2025

and home sales are expected

to go up in 2025.

HAVE A GREAT WEEK!!!!