VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

🏡 Is This the Sweet Spot Home Buyers Have Been Waiting For?

TODAY’S RATES & HOUSING NEWS

Interest rates went up approximately .05%

for the week with the Mortgage Backed

Security (MBS) market trading

down – 16 bps.

On Monday, FED Chairman Powell stated:

“This is not a committee that feels

like it’s in a hurry to cut rates

quickly. If the economy performs

as expected, that would mean two

more rate cuts this year, a total of

50 [basis points] more.”

Much of the market was hoping the

FED would be more aggressive

in their path and statements.

Powell has made it clear that the

FED will follow the data and they

don’t have a preset path of

aggressive rate cuts.

This is a big reason we have seen

rates increase slightly since the FED

lowered the Federal Funds Rate

50 bps.

On Friday, the PCE Inflation report

came out. Year over Year inflation

dropped from 2.5% to 2.2% and

Core Inflation (taking out food and

energy) rose from 2.6% to 2.7%.

The data supports the notion that

inflation is moving closer to the

FED’s target range of 2%.

The big market mover this week is

the BLS Jobs Report on Friday,

October 4th.

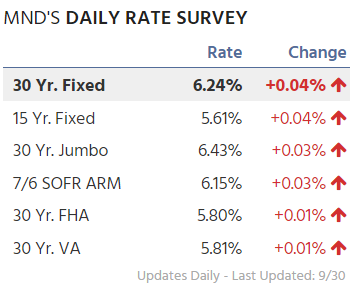

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

IS THIS THE SWEETSPOT HOMEBUYERS

HAVE BEEN WAITING FOR?

With many potential home buyers sitting

on the sidelines waiting for interest

rates to drop, homes continued to rise

in value. This rise in home prices

and likely loan amount and down

payment has taken away a lot of

the benefits of a lower rate.

This could be the sweet spot right now

as interest rates have fallen close to 1%,

and home inventory is starting to rise

thus, lowering the rate of home

appreciation, while also giving buyers

the ability to negotiate favorable terms

with sellers.

If you have been waiting on the sidelines

to purchase, now may be the time to act.

See article below:

HOME PRICES RISE 5% YEAR OVER YEAR

According to the Cash Shiller National

Home Price Index, U.S. home prices

rose 5% year over year and hit

another all-time high.

The pace of appreciation is slowing

significantly, as home prices only

rose .2% from the prior month.

The Case Shiller index is on a

3-month delay and the numbers

are reflective of July 2024. It will

be interesting to see what happens

in the next few monthly reports as

interest rates started falling

significantly in July.

Here is the year over year home appreciation

by city in the 20-city housing index.

1. New York +8.8%

2. Las Vegas +8.2%

3. Los Angeles +7.2%

4. San Diego +7.2%

5. Cleveland +7.0%

6. Chicago +6.7%

7. Detroit +6.6%

8. Boston +6.5%

9. Miami +6.5%

10. Seattle +6.0%

11. Charlotte +5.8%

12. Washington +5.5%

13. Atlanta +4.5%

14. San Francisco +3.4%

15. Phoenix +2.9%

16. Tampa +2.2%

17. Minneapolis +2.0%

18. Dallas +1.9%

19. Denver +1.3%

20. Portland +0.8%

Have a great week!