VIDEO UPDATE: Rates Close to 3 Month Lows, New Down Payment Assistance Option, Here is…

🏡 March Market Update: What’s Happening with Rates and Housing

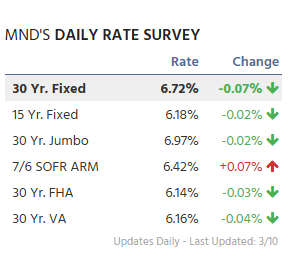

TODAY’S MORTGAGE RATES

Mortgage Interest Rates teetered up and

down for the week but settled about the

same place they started. The Mortgage

Backed Security (MBS) market traded

down – 11 bps for the week.

Below are Mortgage News Daily’s

Average Interest Rates across

the country.

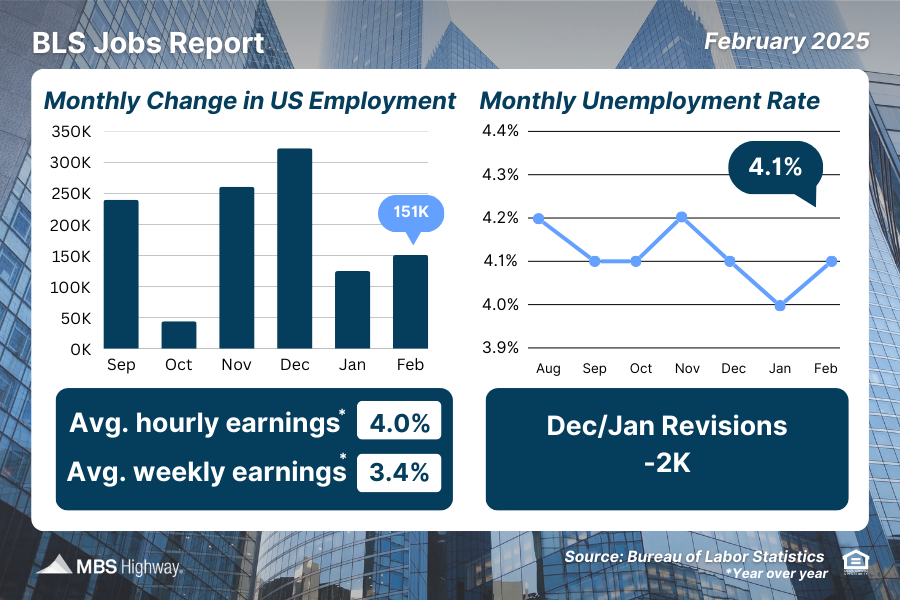

February’s BLS Jobs Report was released

on Friday. The BLS Jobs Report is

typically one of the most important

reports that influences interest rates

for the month.

There were a reported 151,000 jobs

created in February – lower than

estimates. Unemployment also

went up from 4% to 4.1%.

These numbers would usually improve interest

rates and they did for a period of time, but

Fed Chair Powell’s speech later in the

day reversed the market to interest

rates going up on the day.

Powell stated that the FED still needed

to be patient on further rate cuts and

were waiting to see how the new

government regulations would affect

prices and labor. The market is expecting

multiple FED rate cuts this year and

Powell’s words did not lend credence

to more rate cuts, at least right now.

There are a lot of characteristics that

go into a mortgage rate – credit score,

investor, loan to value, loan amount,

costs, etc. Please call me to go over

your specific scenario so we can

price your loan out accurately.

Or email me at reggie@mygreenhomeloans.com with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Debt Consolidation:

Address of Home:

Estimated Value of Home:

Current Loan Amount:

Current Rate:

What Type of Loan Are You in Currently – FHA, VA, Conventional:

Estimated Credit Score:

Are You a Veteran or Active Member of the U.S. Military:

If You are a Veteran, Do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State are You Looking to Purchase In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the U.S. Military:

If You are a Veteran, Do you get VA Disability:

Thank you!

MARCH 2025 REAL ESTATE REPORT

Keeping Current Matter’s March Real

Estate Market Report is below:

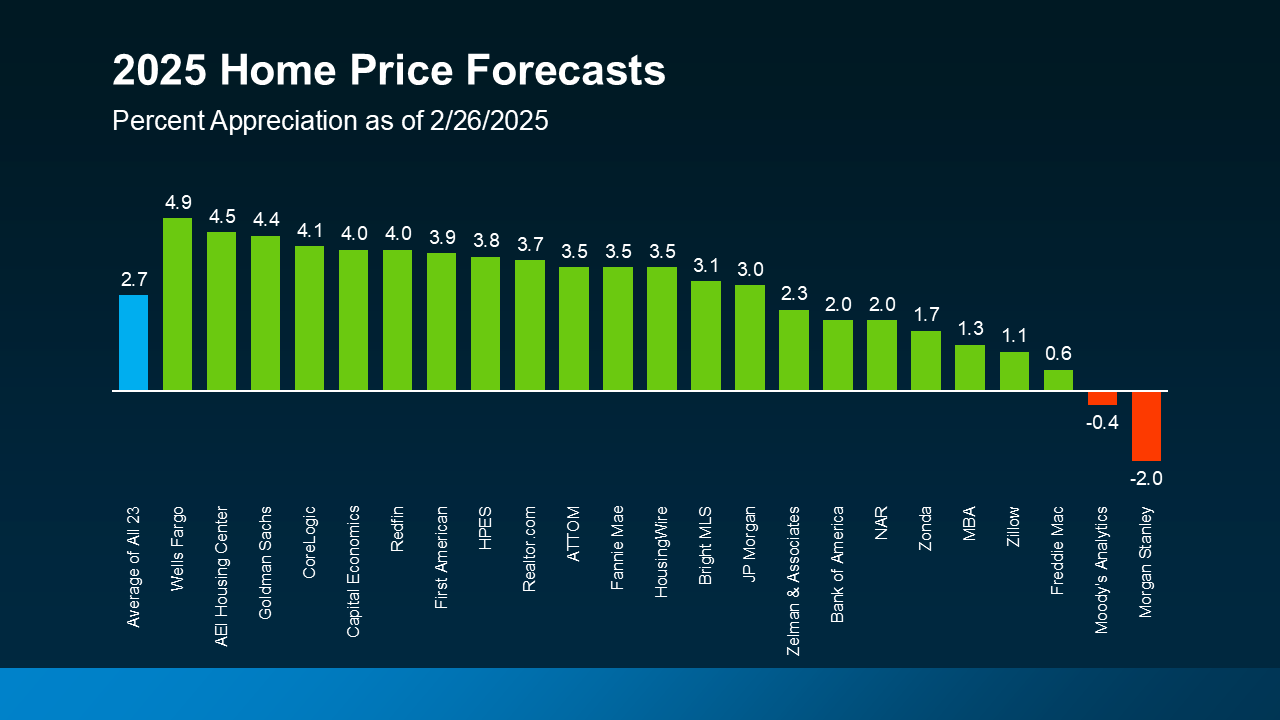

Home Price Forecasts are still showing

moderate home price increases for 2025.

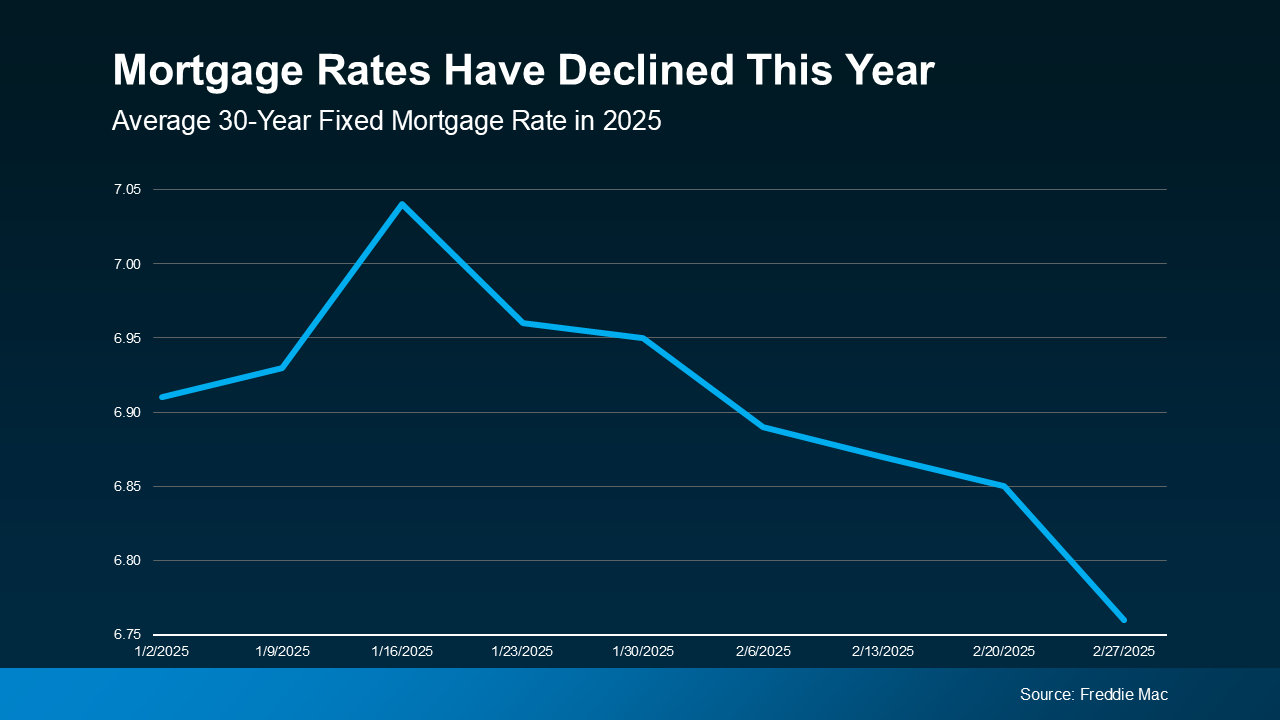

Mortgage Rates have declined steadily

this year.

Lower rates along with more inventory

puts buyers in a favorable position going

into the Spring Buying Season.

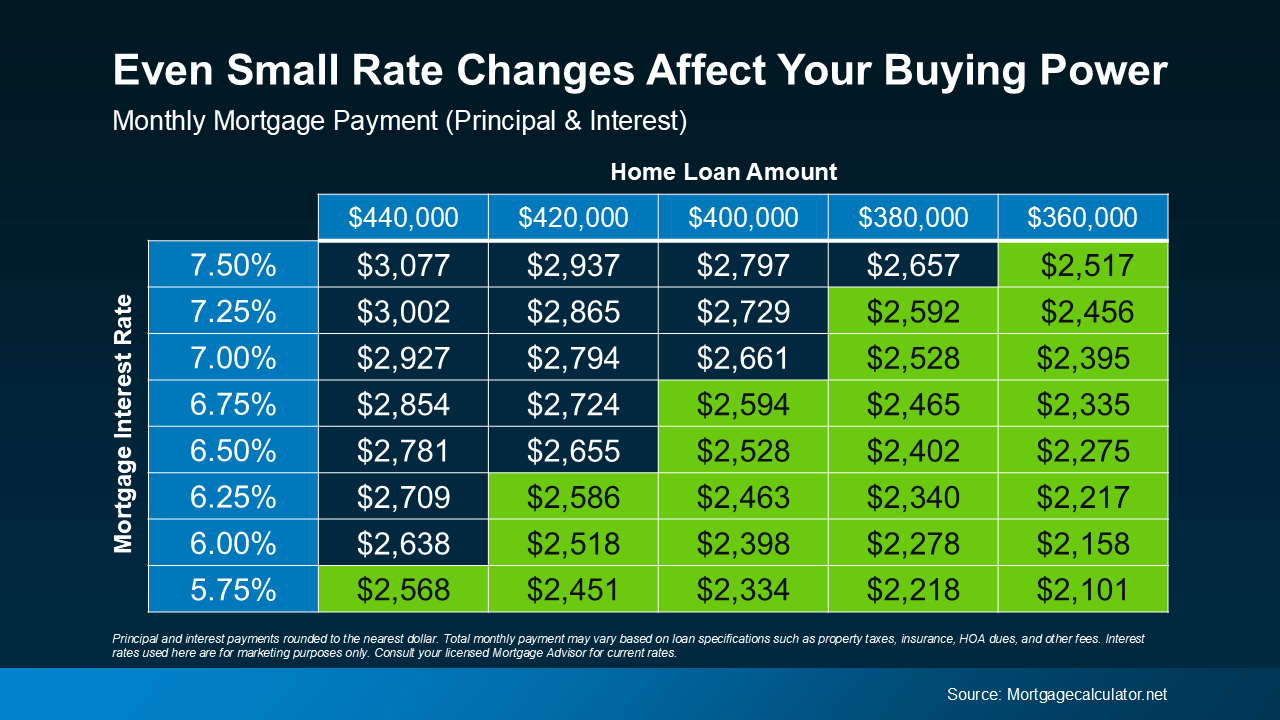

Even small rate improvements can help

consumers have more affordable

payments.

Have a great week!