VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

🏡 Why an Appraisal Over Purchase Price Is a Game-Changer for Home Buyers.

TODAY’S RATES & HOUSING NEWS

Interest Rates moved up .15% this

week with the Mortgage Backed

Security Market (MBS) trading down

-56 bps. The 10 Year Treasure

currently sits at 4.37%.

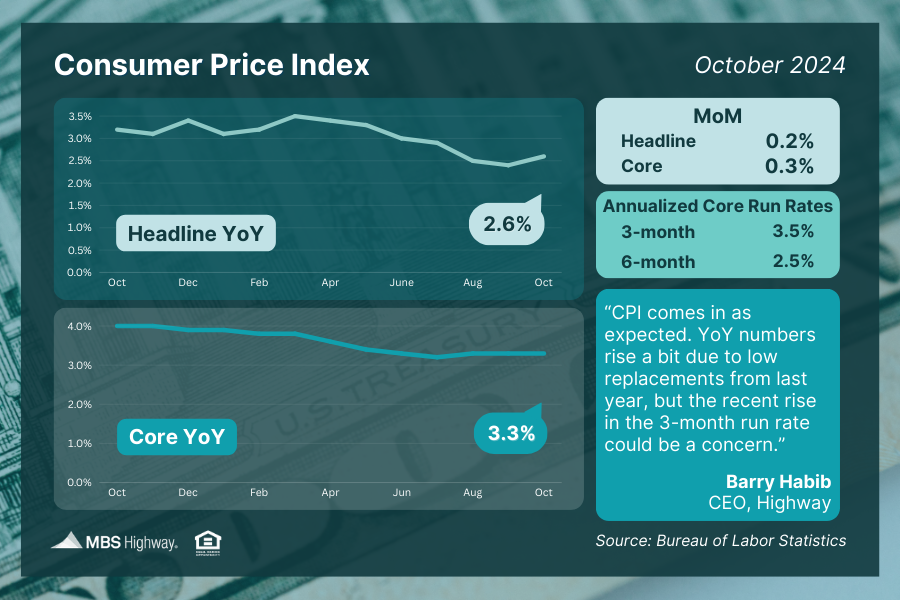

On Wednesday, the Consumer Price

Index was released and the numbers

came in close to expectations. Year

over Year Inflation went to 2.6%

and Core Inflation went to 3.3%.

The biggest concern is the 3 month

average inflation would equate to

yearly inflation of 3.5%, well above

the FEDs target number. Mortgage

interest rates usually follow inflation

so we want to see inflation come

down for better interest rates.

While interest rates went up some

on Wednesday, since then interest

rates have moved down.

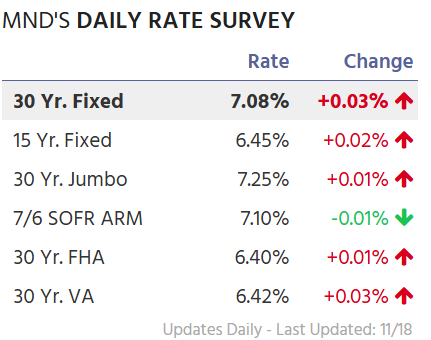

Below are Mortgage News Daily’s

average interest rates across the country.

There are a lot of characteristics that

go into a mortgage rate – credit score,

investor, loan to value, loan amount,

costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

Why an Appraisal Over Purchase Price

Is a Game-Changer for Home Buyers

We have seen an increasing number

of homes under contract appraise

higher than the purchase price. This

happens a lot during the Holiday

Season because demand is lower and

home buyers can often get a great

deal on a home. A high appraisal is

not only a huge benefit to homeowners

by walking into immediate equity, but

it also gives homeowners a great way to

negotiate the terms to get a better payment.

Let’s show a real-life example.

Client is purchasing a $500,000 home

putting 5% down. The client originally

locks in a 7% rate, putting their

payment at $3,160.19.

$500,000 Purchase Price

$25,000 Down Payment

Monthly Payment of $3,160.19

Once the appraisal is completed, the

home appraises at $525,000,

$25,000 higher than the

purchase price.

We discuss the possibilities with the

client and buyer’s agent and the

Realtor negotiates to raise the

purchase price to $510,000, and gets

the buyer $10,000 in seller concessions.

Lenders calculate down payment on

the lower of the purchase price or

appraisal. Since the appraisal is high,

we can loan at the same percentage

down when raising the purchase price.

While raising the purchase price may

seem like a backward approach, let

me show you how it affects your

terms and you can decide which

option you would prefer.

Client is purchasing a $510,000

home putting 5% down. The client

adjusts lock to a 6.25% rate by

using seller concessions to buy down

the rate. Client’s new principal and

interest payment is $2,983.15.

$510,000 Purchase Price

$25,500 Down Payment

Monthly Payment of $2,983.15.

Let’s look at the major benefits

to the buyer.

$177.04 Lower Monthly Payment

.75% Lower Rate

Only a $500 Higher Down Payment

We have closed many deals in

November using this same strategy.

The key is getting a good deal on

the price, hopefully having an

appraisal come in over the purchase

price, and working with an

experienced Mortgage Broker to

help show you your options.

Have a great week!