TODAY’S MORTGAGE RATES Mortgage Interest Rates teetered up and down for the week but settled…

🕺 Good News: Interest Rates Drop After Latest Inflation Report!

VIDEO UPDATE:

Interest Rates Improve after Inflation Report. Here is Your Weekly Mortgage Rate Update!

TODAY’S RATES & HOUSING NEWS

Mortgage interest rates improved

approximately .2% over the past 7

days. The Mortgage Backed Security

(MBS) market traded up 66 bps.

The 10 Year Treasury currently sits

at 4.57%.

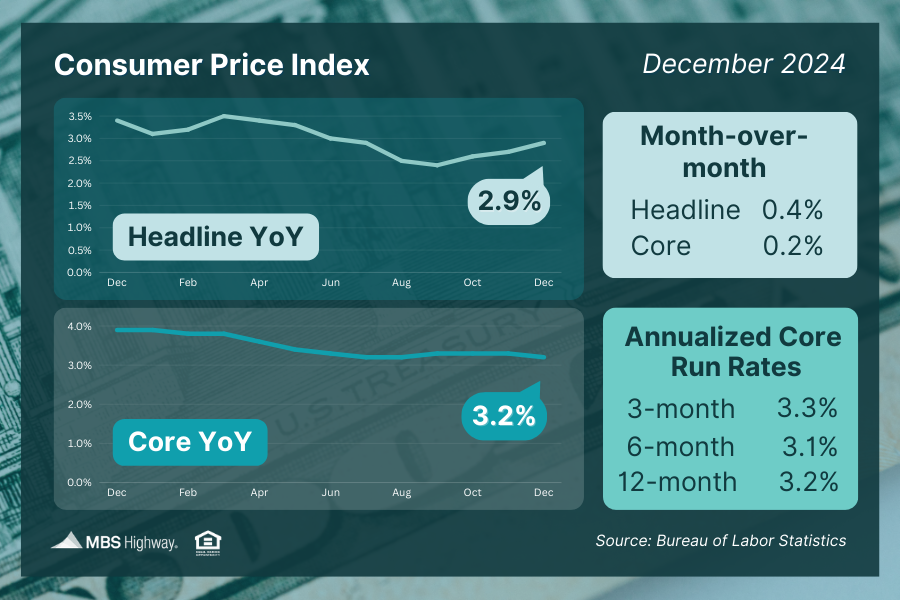

The big news last week was the

December Consumer Price Index

(CPI) Inflation Report. Year over

Year Inflation increased from 2.7%

to 2.9%. The Core Inflation number

which strips out food and energy came

in lower than expected. Core inflation

dropped from 3.3% to 3.2%.

This lower number in core inflation

helped create a bond rally on

Wednesday of positive +56 bps.

The chart below breaks down the

Mortgage Backed Security Market

over the past 3 months. Mortgage

rates jumped after the new year – you

can see this with the MBS market

trading down (in red) in January. The

recent uptick in the MBS market has

interest rates near the levels of mid-

December 2024 – December 31st,

and very similar to where rates were

for the majority of November.

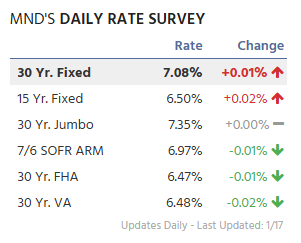

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

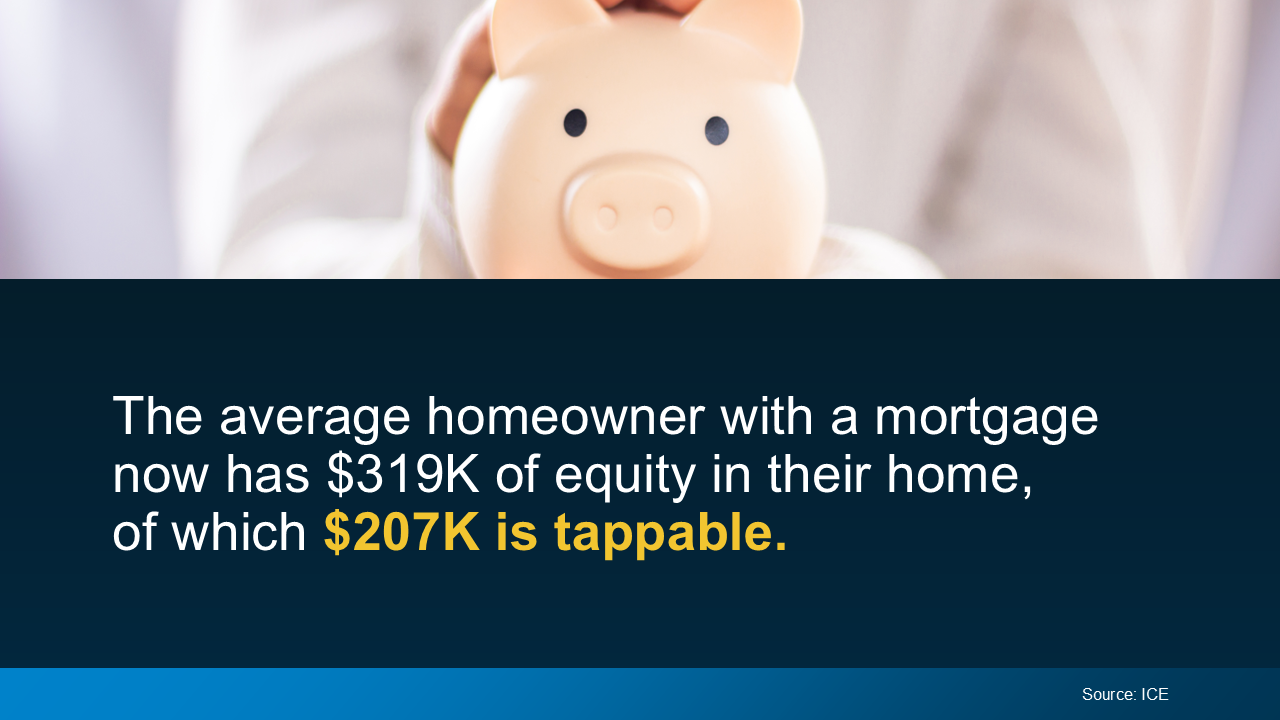

HOME EQUITY IN AMERICA

Americans are sitting on a record

amount of equity in their homes

in 2025.

The average American homeowner with

a mortgage has $319,000 in home

equity, with $207,000 they could

tap into.

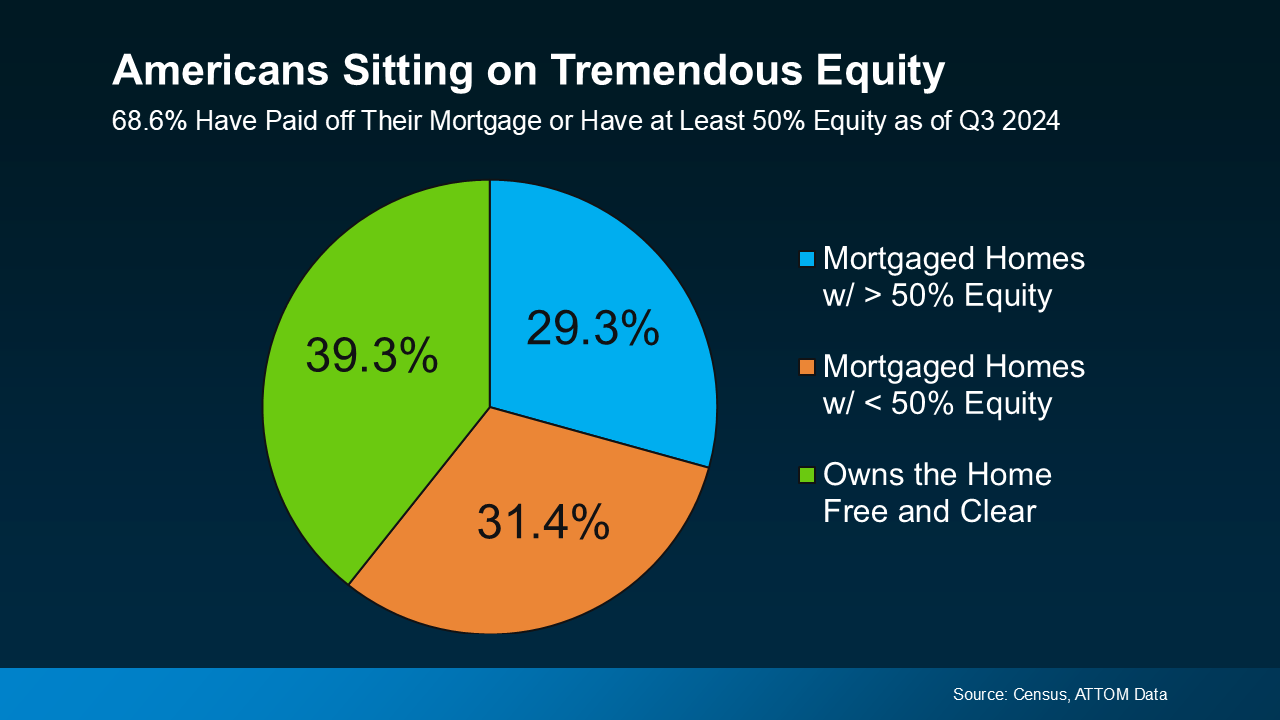

68.6% of Americans have at least

50% equity in their home.

Over the past decade, the typical

homeowner has accumulated

$201,600 in wealth solely on home

price appreciation. Over the past 5

years, the typical homeowner has

accumulated $147,000 in wealth on

home price appreciation.

If you would like to look at options to use

your home equity, please contact me

and let’s discuss your options.

Have a great week!