VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

🏡 Homebuyers Speak Out: The Mortgage Rate They Need Before Purchasing

VIDEO UPDATE:

What are Today’s Mortgage Rates? (youtube.com)

TODAY’S RATES & HOUSING NEWS

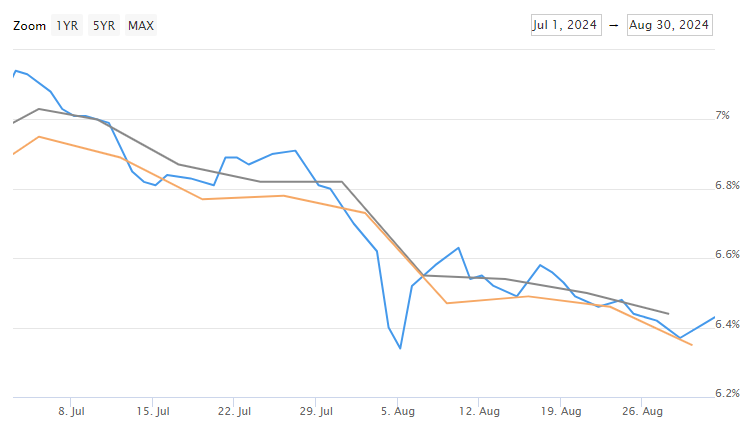

Interest rates went up ever so

slightly this week with the Mortgage

Backed Security (MBS) market

trading down – 12 bps on the week.

After a big move down in July and

the beginning of August, you’ll see

in the chart below that interest

rates have remained pretty steady

in the same range since mid-August.

On Friday’s PCE Inflation Report, we

had a nice month over month inflation

number of .155%. Year over Year

inflation stayed at 2.5%, with Core

Inflation (taking out food and energy)

remaining at 2.6%.

Because the numbers came close

to expectations, we didn’t see

much market movement.

The big news coming up this week

is the BLS Jobs Report on Friday.

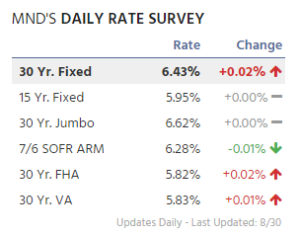

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

HOMEBUYERS REVEAL HOW LOW

MORTGAGE RATES MUST GO

BEFORE THEY BUY A HOUSE

This is an insightful article from Realtor.com

profiling a number of would-be home

buyers and how low rates will have to

go before they purchase a home.

https://www.realtor.com/news/trends/waiting-for-interest-rates-to-drop-before-buying-a-house/

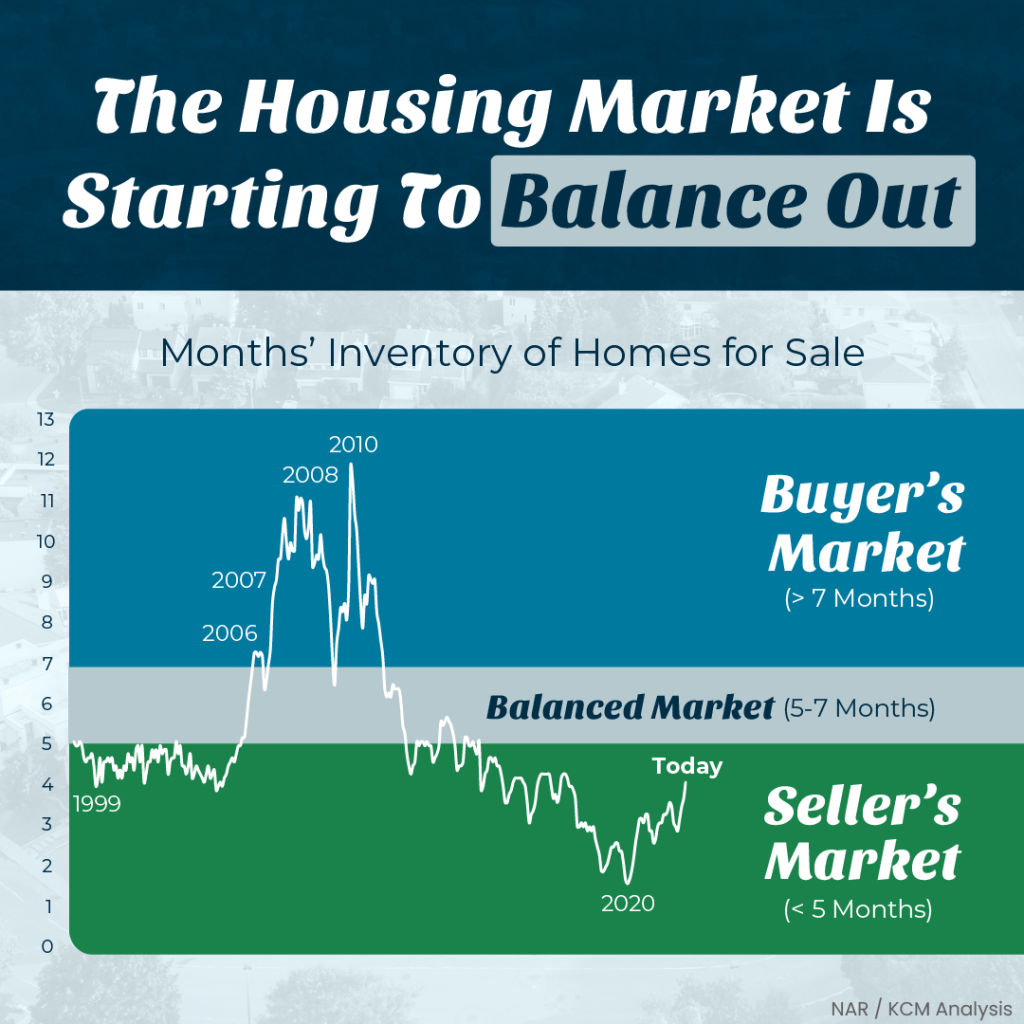

THE HOUSING MARKET IS

STARTING TO BALANCE OUT

National housing inventory is in the

4-month range, meaning that it

would take approximately 4 months

to sell all homes on the market today.

We are still in a seller’s market, but

buyers have many more options and

much more negotiating power in price

and seller concessions in many

areas of the country.

Have a great week!