VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

🎃 October 2024 Real Estate and Mortgage Report

VIDEO UPDATE:

Mortgage Interest Rate Update – October 2024 – YouTube

TODAY’S RATES & HOUSING NEWS

Interest rates rise slightly after a

relatively uneventful week in trading.

The Mortgage Backed Security (MBS)

market traded down – 20 bps. The 10

Year US Treasury sits at 4.0728%.

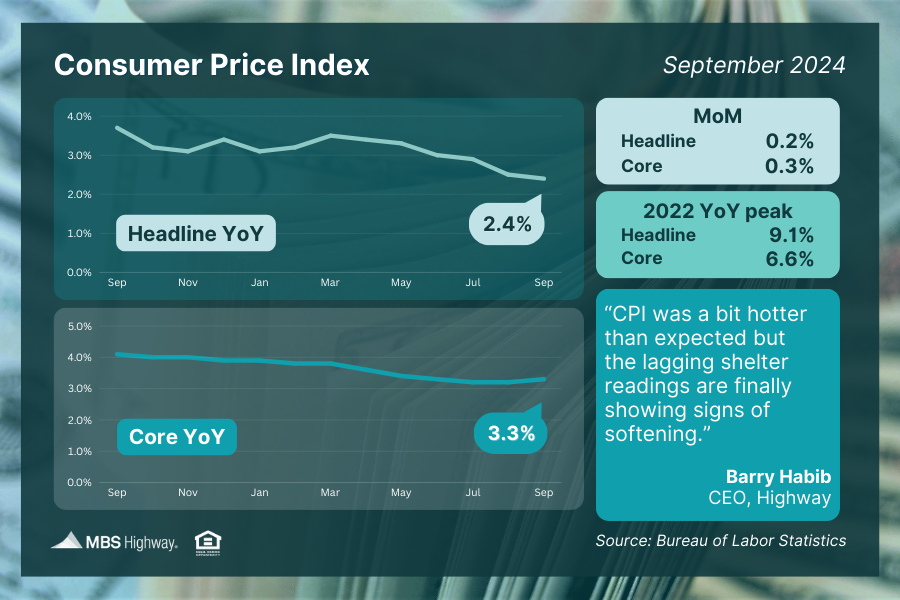

The big market mover last week was

the Consumer Price Index Inflation

Report.

Year over year inflation came in at

2.4% above the 2.3% projection.

Core inflation came in at 3.3% above

the 3.2% projection.

Inflation is remaining relatively low

and close to projections.

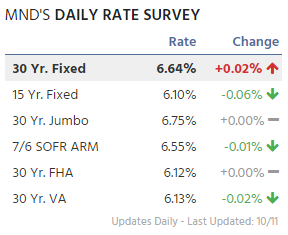

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

OCTOBER 2024 REAL

ESTATE REPORT

Here is the audio of Keeping Current

Matter’s October 2024 Real Estate

Report.

Here are some of my favorite

slides from the presentation.

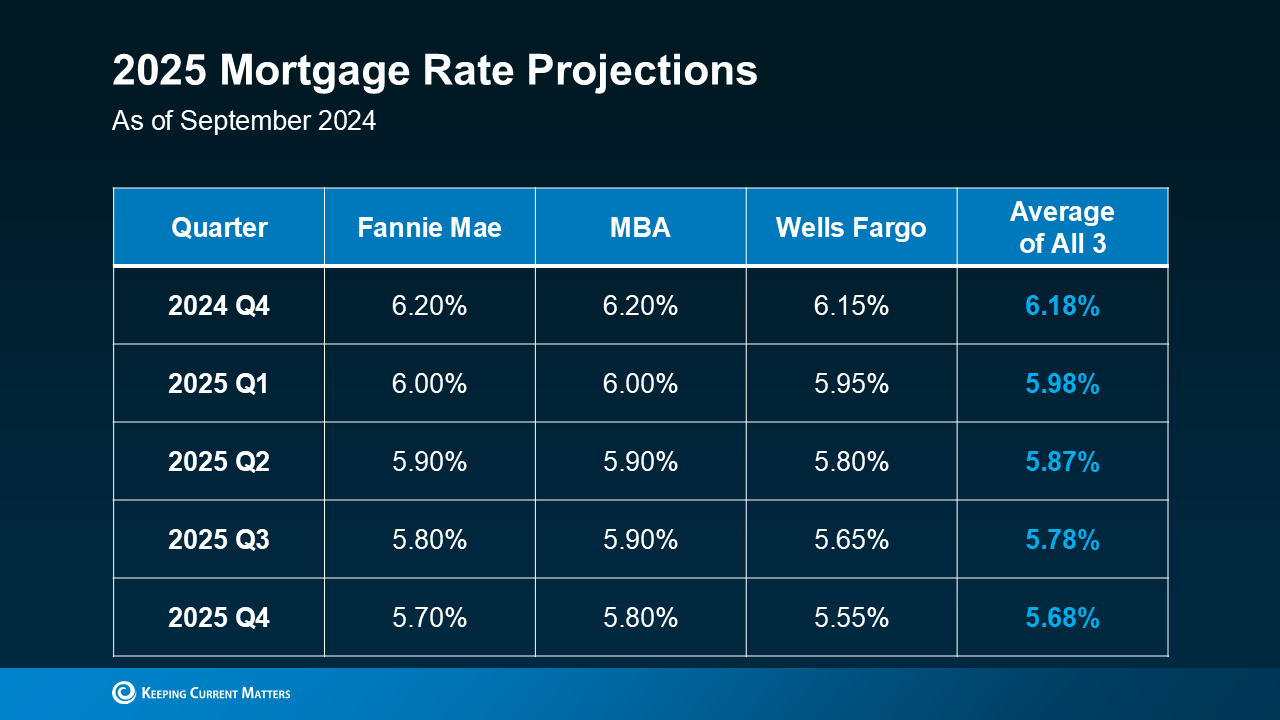

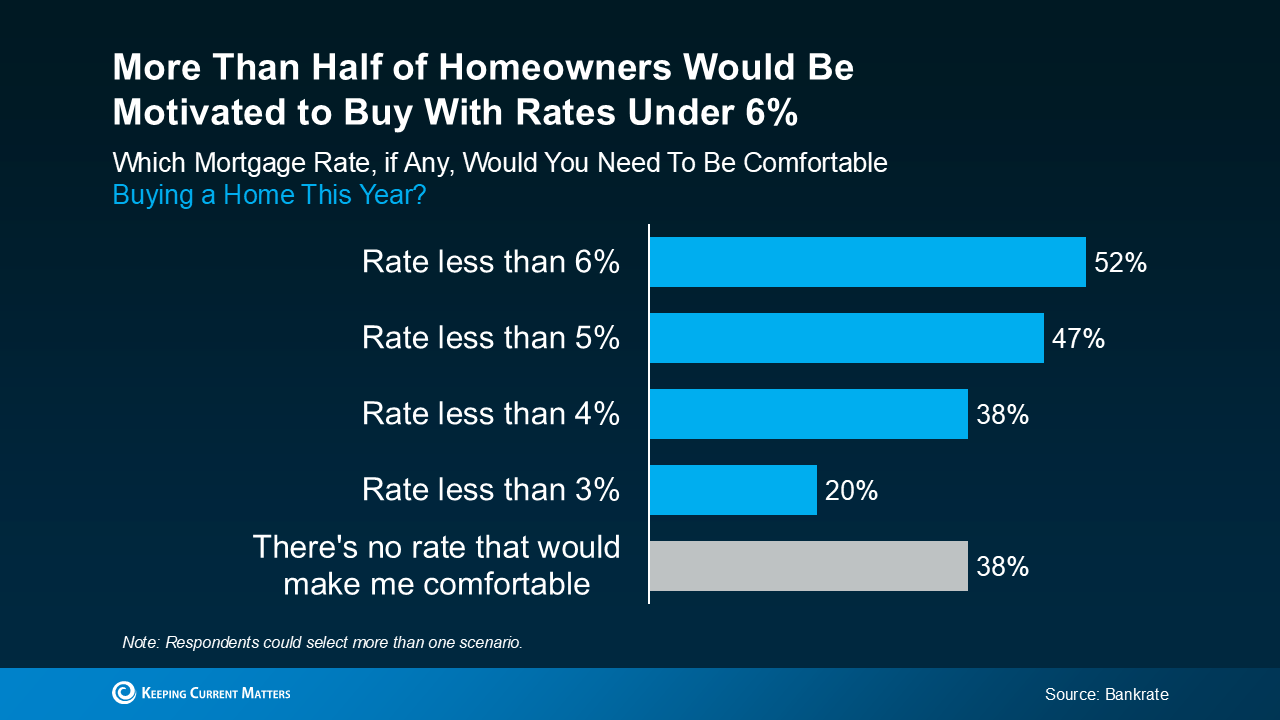

Here are the expectations of

where mortgage rates will go.

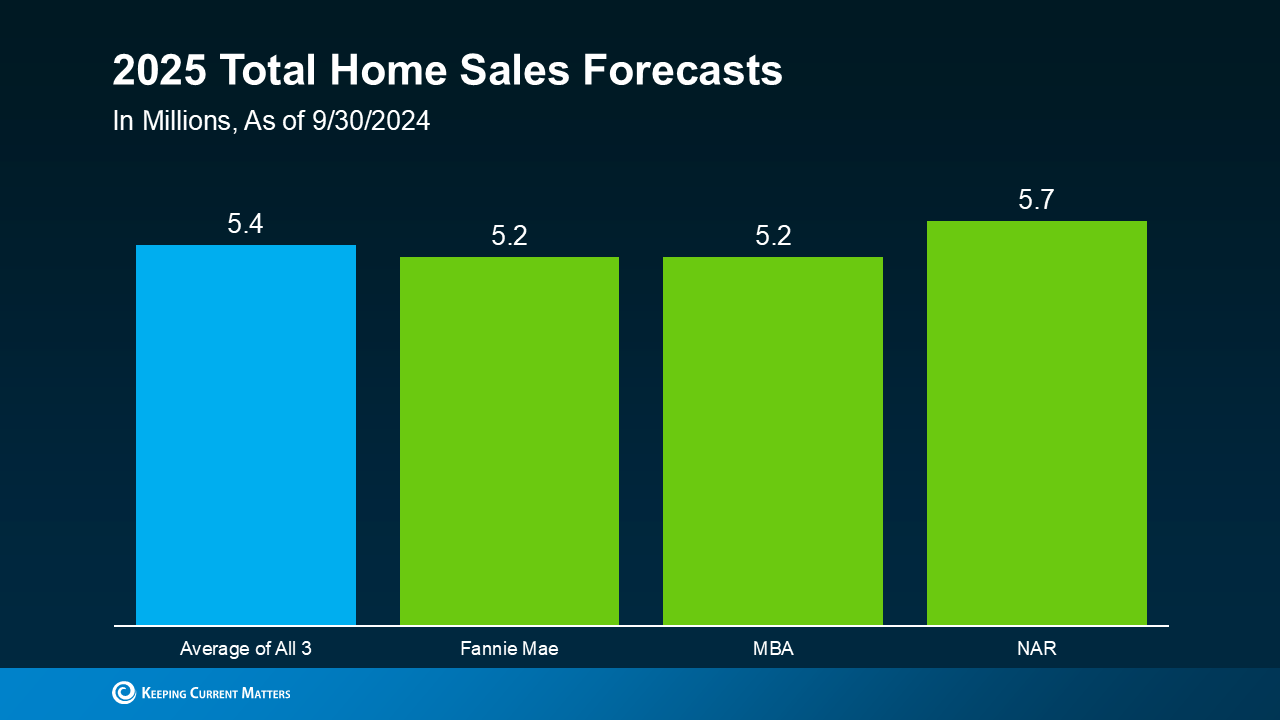

With expected lower mortgage rates,

KCM expects higher demand to

purchase homes.

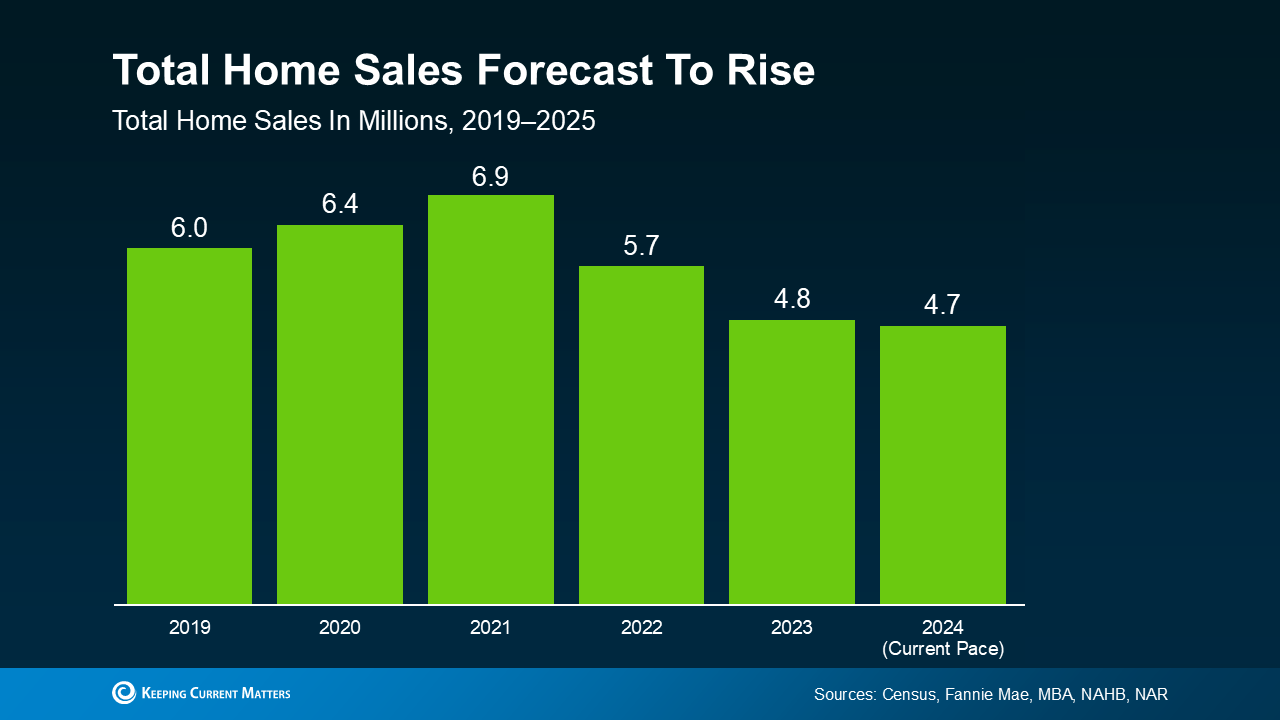

Total homes sales have went down

since their peak in 2021.

But are expected to rise in 2025.

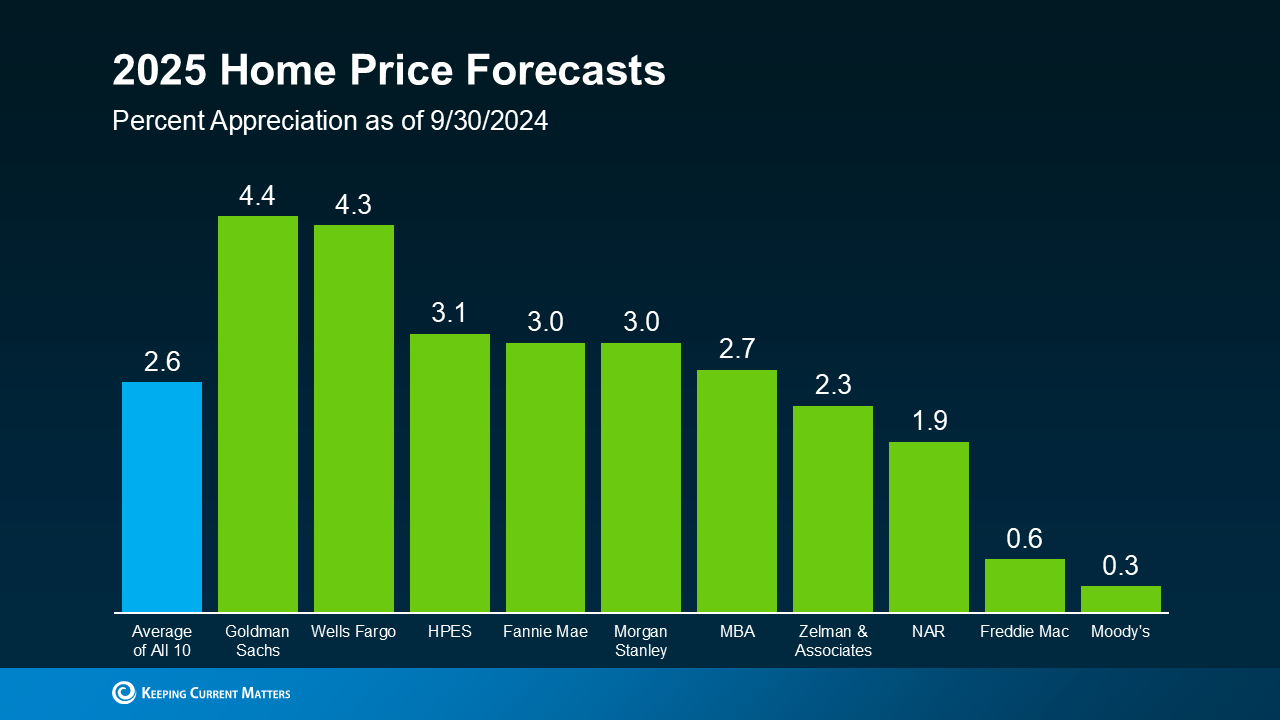

Home Prices are also expected to

rise in 2025.

Have a great week!