VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

💁♂️ How the Election Impacts Home Buying and Interest Rates

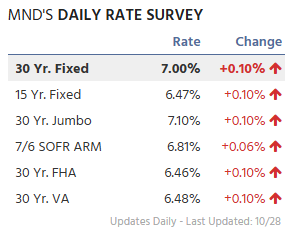

TODAY’S RATES & HOUSING NEWS

Average 30 Year Fixed Interest Rates

across the country have officially hit

7%. The Mortgage Backed Security

(MBS) market traded down -81 bps

over the past 7 days. The 10 Year

Treasury currently sits at 4.3305.

Interest rates have moved up

significantly in October 2024 and we

are heading into a big week of data.

See data below (mortgage news daily

blue line is most accurate)

The most important reports will be

the PCE Inflation report on Thursday

and the BLS Jobs Report on Friday.

These reports have the capability to

catapult rates even higher or give

us some relief with a correction.

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your

specific scenario so we can

price your loan out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

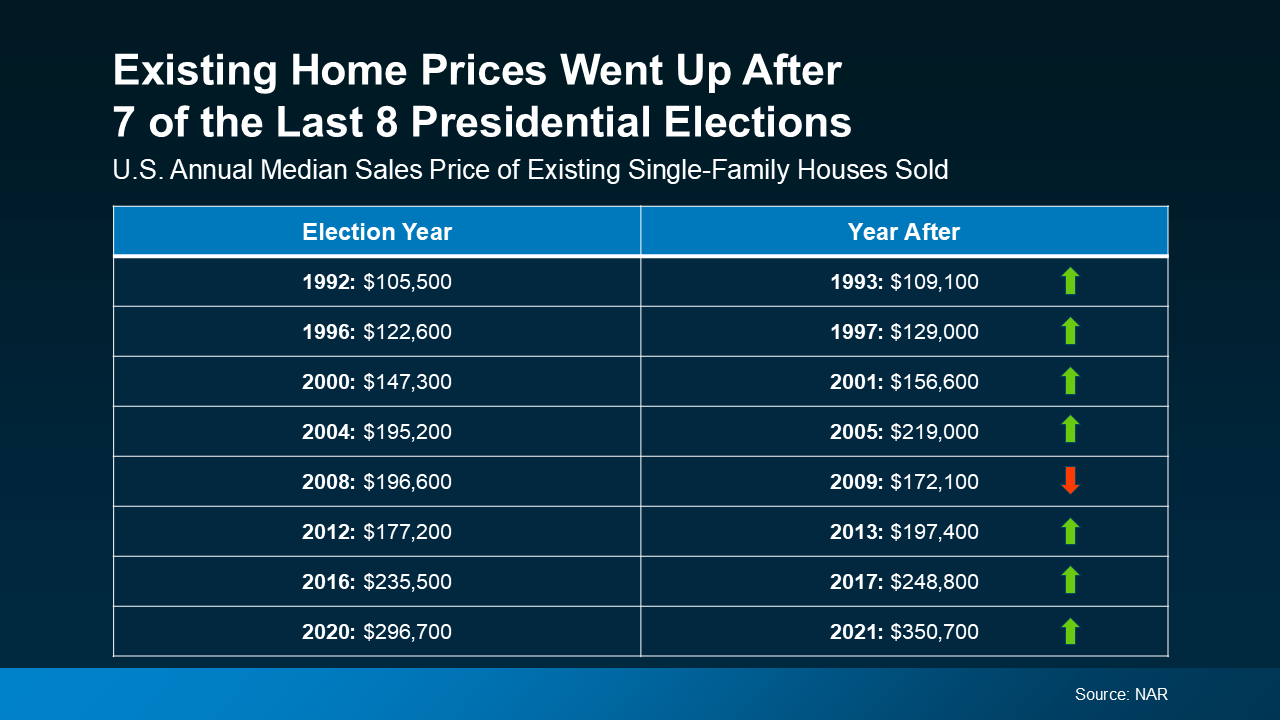

HOW THE ELECTION

IMPACTS HOME BUYING

Historically, the U.S. presidential election can

have a notable impact on the housing market,

particularly around October and November,

as prospective homebuyers react to economic

uncertainties and potential policy changes.

Here are some of the main historical trends:

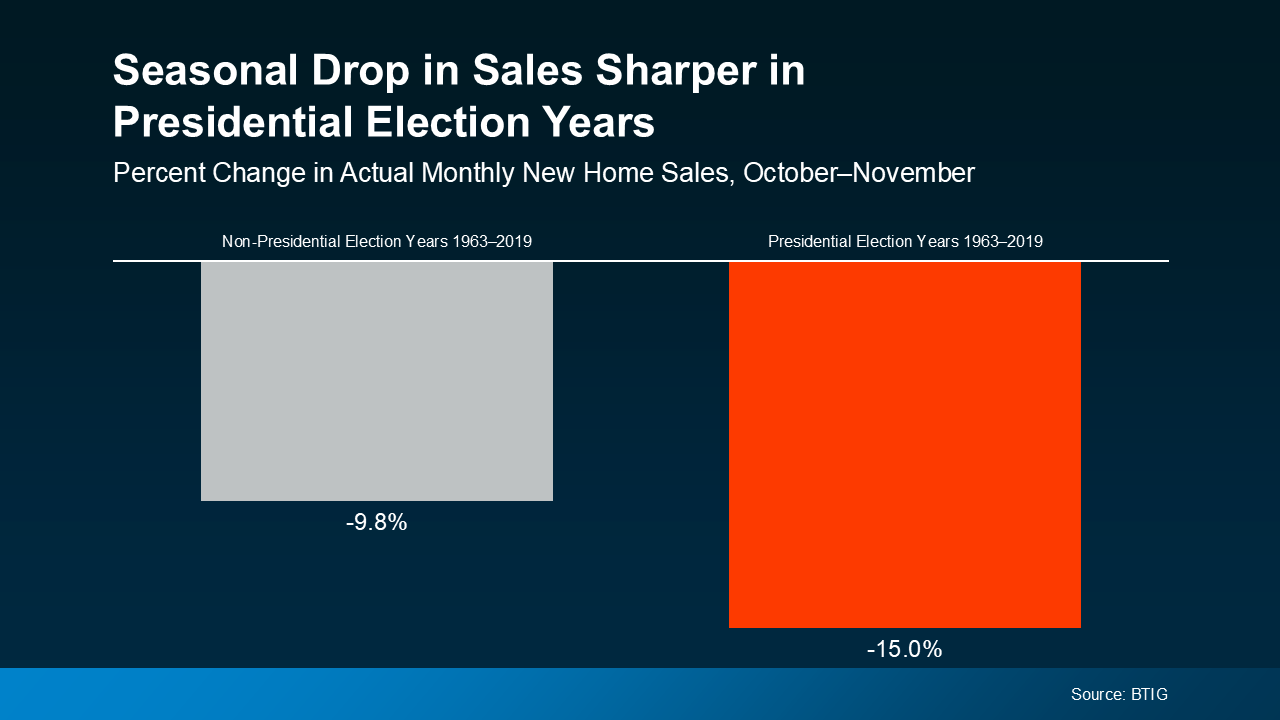

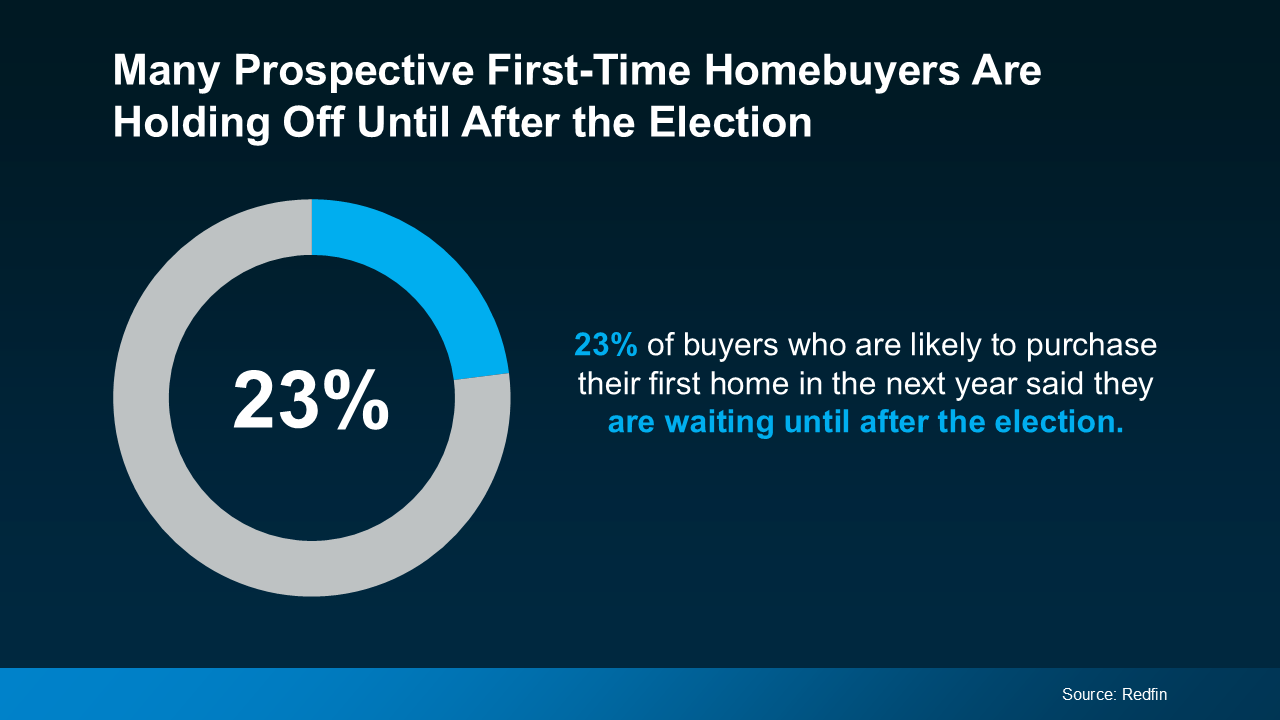

1. Buyer Hesitation and Market Slowdown:

Buyers often pause major financial decisions

during election season, which can lead

to a temporary slowdown in the housing

market. This is typically due to uncertainty

around possible policy changes and economic

stability, with people taking a “wait-and-see”

approach. As a result, home sales and new

listings sometimes decrease in the months

leading up to and immediately following

the election.

2. Interest Rate Volatility:

Elections can lead to short-term

fluctuations in mortgage rates. Markets

may respond to election polls, debates,

and economic policy proposals, which

can impact the 10-year Treasury yield—

a key influence on mortgage rates. If

rates are predicted to rise or if there’s

a belief in potential economic stimulus,

buyers may rush to secure a home loan

before rates increase, driving short-term

demand.

3. Policy-Driven Market Adjustments:

Depending on the candidates’ policies, buyers

may anticipate changes in housing regulations,

tax breaks, or loan accessibility. For example,

if a candidate’s platform strongly supports

first-time homebuyers or promotes housing

affordability, there may be increased optimism

and interest in purchasing sooner.

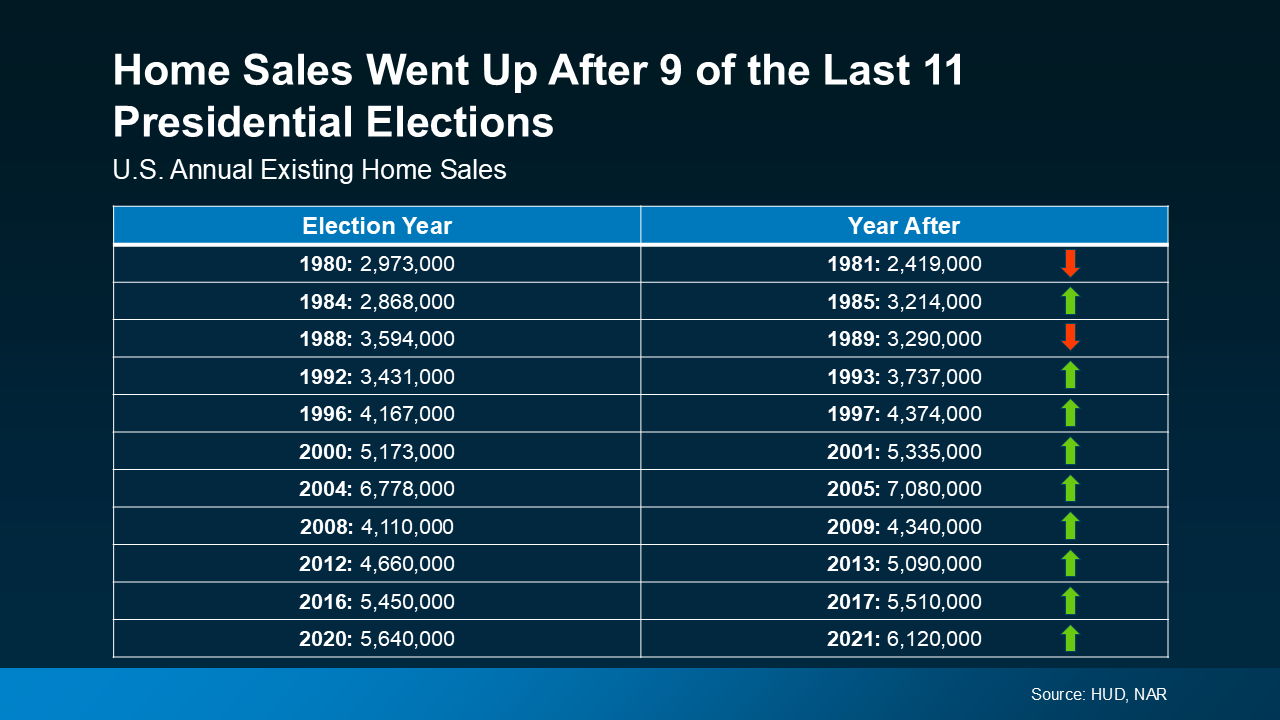

4. Post-Election Stabilization:

Generally, the market stabilizes after the

election as the new or re-elected

administration outlines clearer plans. Historically,

this post-election period often sees an uptick in

home-buying activity as uncertainty diminishes.

Overall, while the presidential election

typically causes temporary fluctuations

in home buying, the market usually

stabilizes shortly after as policies and

economic trends become clearer.

Have a great week!