VIDEO UPDATE: Interest Rates Improve Despite Higher Inflation, Here is Your Weekly Mortgage Rate Update…

💥 Interest Rates Rise .4%

TODAY’S RATES & HOUSING NEWS

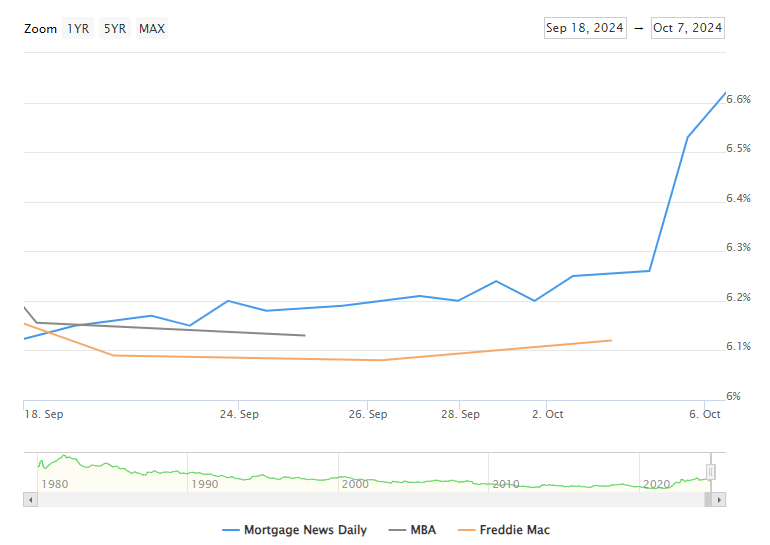

Interest rates had a tough week,

jumping about .4% in the past

7 days.

The Mortgage Backed Security Market

traded down -80 bps over the past 7

days and the 10 Year Treasury

moved above 4% to 4.0314%.

Below are where 30 Year Fixed

Mortgage Interest Rates have

headed since the FED lowered the

Federal Funds Rate on September

18th. The Blue Line is accurate as

there is no lag in the data.

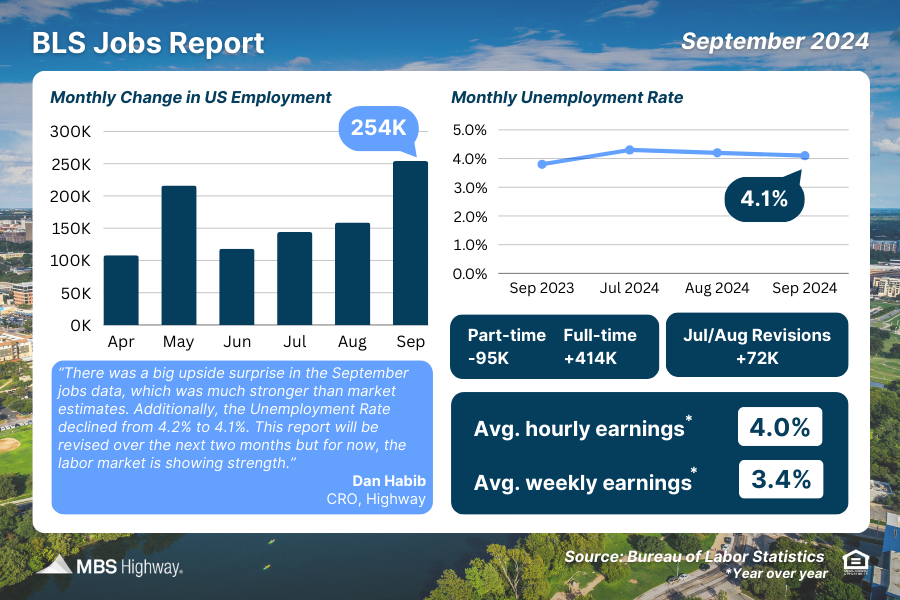

The BLS Jobs Report on Friday showed

254,000 jobs created in September

2024, crushing the expectation of

140,000 job creations.

There were also upward revisions of

72,000 jobs on the prior 2 months.

While jobs are good for the economy,

positive economic news is generally

bad for mortgage interest rates.

The big potential market mover this

week is Thursday’s Consumer Price

Inflation Report.

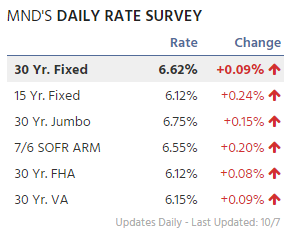

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

REFINANCE OPPORTUNITIES

USUALLY DON’T LAST LONG

Every Mortgage Professional in the country

has clients they presented refinance numbers

to where their clients could have saved

money on their rate and mortgage

payments with minimal costs only for

their customers to wait hoping for more

savings in the future.

Rates have jumped .5% since then

and many of those refinance

opportunities no longer make sense.

Here are the best ways to take advantage

of refinance opportunities.

1. PLAN AHEAD

Call me and we can discuss a rate that

would make sense for you to refinance.

2. BE READY

We can then use our technology to

automatically be notified when your target

rate hits. We can have your application

prepared in our system so we can pull

your credit and lock on the same day

your target rate hits.

Interest rates typically hit a down cycle

for 1-3 days and then move back up.

It’s essential to be ready to lock when

your target rate hits.

One thing I can’t stress enough

is this. Customers often read headlines

and think mortgage rates will go in a

specific direction. This very rarely happens

and if it does, the road is typically longer

and rockier than expected.

If you can refinance and lower your

rate and payment while recouping

your costs in a relatively short

period of time (2 to 3 years), I

recommend taking the guaranteed

savings verses the prospect of slightly

higher savings in the future.

Have a great week!