VIDEO UPDATE: Tariff Hysteria and Up and Down Interest Rates, Here’s Your Weekly Mortgage Rate…

🏡 Interest Rates Improve to Best Levels in a Month!

VIDEO UPDATE:

Interest Rates Improved to Their Lowest Levels in a Month.. Here’s Green Home Loans Weekly Mortgage Rate Update.

TODAY’S RATES & HOUSING NEWS

Interest rates improved to their best

levels in a month with the Mortgage

Backed Security (MBS) market

trading up +37 bps. The 10 Year

U.S. Treasury is currently at 4.30%.

The biggest news on the week

was Trump’s pick for Treasury

Secretary – Scott Bessent. The market

liked the pick, and both the stock

and bond markets went up on

Monday after the pick was announced.

Bessent is considered fiscally conservative.

If the Treasury isn’t issuing as much

debt, it’s easier for mortgage interest

rates to move lower.

The big potential market mover this

week is Wednesday’s PCE Inflation

Report.

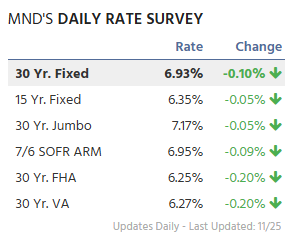

Below are Mortgage News Daily’s

average interest rates across the country.

There are a lot of characteristics that

go into a mortgage rate – credit score,

investor, loan to value, loan amount,

costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

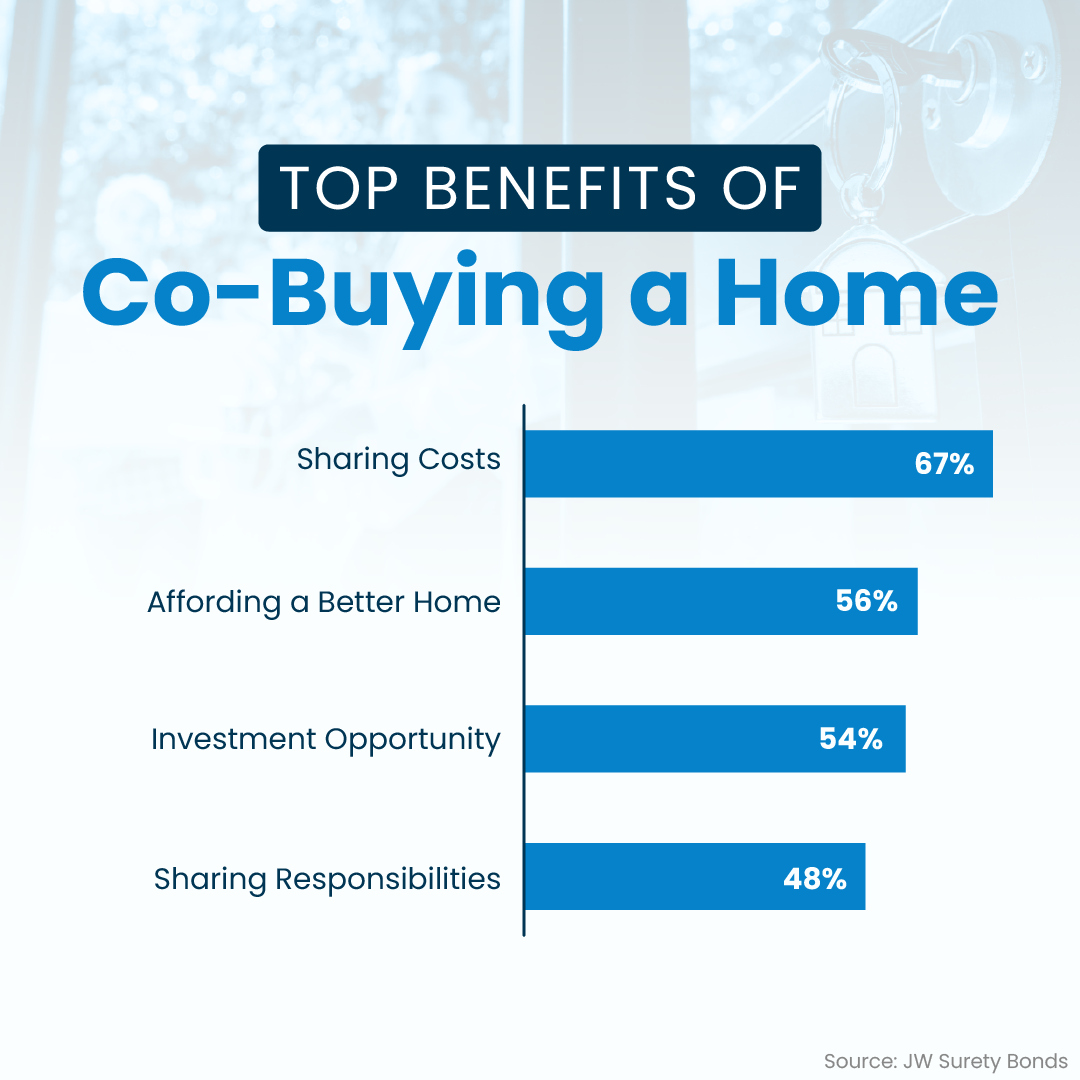

TOP BENEFITS OF CO-BUYING

A HOME

Co-purchasing a home with a friend

or family member is becoming an

increasingly popular way to achieve

homeownership without taking on the

full financial burden alone. Here’s why

this approach might be a smart move

for you:

1. Shared Financial Responsibility

Co-purchasing allows you to split the

costs of the down payment, mortgage

payment, property taxes, and

maintenance expenses. This shared

financial responsibility can make

homeownership more affordable and

reduce the strain on any one individual.

2. Boosted Buying Power

Pooling resources with another buyer

may increase your combined purchasing

power, allowing you to afford a larger

home, a better neighborhood, or a

property with more amenities.

3. Faster Path to Ownership

Saving for a down payment can take

years when doing it solo. By joining

forces with someone else, you can

reach your financial goals faster and

enter the housing market sooner,

potentially benefiting from property

appreciation.

4. Shared Living Arrangements

If you plan to live in the home together,

you can split household expenses such

as utilities and upkeep, reducing your

monthly out-of-pocket costs. This

arrangement can also foster closer

bonds with loved ones.

5. Opportunity to Build Equity

Instead of paying rent, co-owning a

home allows both parties to build

equity over time. This equity can

be used as a foundation for

future investments or to achieve

personal financial goals.

6. Flexibility in Ownership Terms

With clear communication and proper

legal agreements, co-purchasing

can be customized to fit your needs.

For example, you can define ownership

shares, decide how profits will be split

if the property is sold, or outline exit

strategies in case one party wants to

move on.

Things to Consider

While co-purchasing offers many

advantages, it’s essential to plan carefully.

Drafting a co-ownership agreement with

the help of an attorney can clarify

expectations, responsibilities, and future

plans, helping to avoid misunderstandings.

If you’re considering co-purchasing a

home, we can guide you through the

mortgage process and help you find

the best financing solutions.

Have a great week!!!