VIDEO UPDATE: Tariff Hysteria and Up and Down Interest Rates, Here’s Your Weekly Mortgage Rate…

🏡 Where are Rates Headed after Blockbuster Jobs Report?

VIDEO UPDATE:

TODAY’S RATES & HOUSING NEWS

Mortgage Interest Rates went up

about .15% over the past 7 days.

The Mortgage Backed Security

(MBS) market traded down -68

bps. The 10 Year Treasury currently

sits at 4.778%.

Interest Rates are actually better than

you would think they would be with

the major market movement on

Friday, January 10th.

On Friday alone, the MBS market

sold down -52 bps after a strong

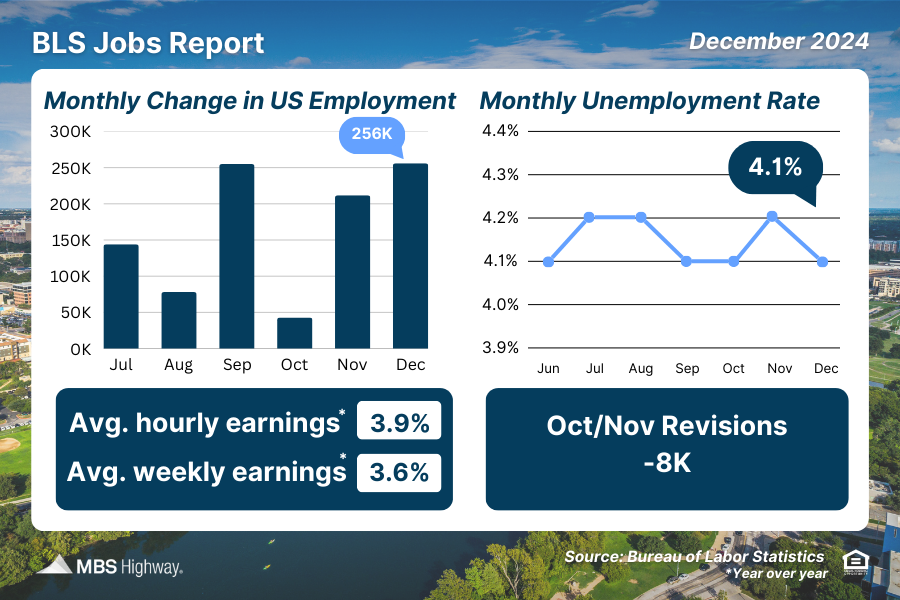

BLS Jobs Report. BLS reported

that there were 256,000 jobs created

in December, much higher than the

anticipated 160,000 jobs.

Unemployment also dropped

from 4.2% to 4.1%.

Bank of America came out after

the Jobs Report and stated they

are adjusting their outlook to No

More FED rate cuts in 2025 with

the possibility of a hike. Goldman

Sachs adjusted their outlook to 2

rate cuts instead of 3 rate cuts

in 2025.

There is no sugar coating it,

it’s a volatile time for interest

rates. If the economy still shows

good job creation, low unemployment

and inflation remains above target, its

less and less likely that interest rates

will go down in 2025.

This week the market will be

dominated by inflation numbers.

The Producers Price Index will be

released Tuesday and the Consumer

Price Index will be released Wednesday.

Both Inflation Reports are expected

to go higher.

Remember that using Seller Concessions

can help you get a much lower rate

than the current market. Below is an

article discussing Seller Concessions

and how you can use them to get

better terms and lower payments.

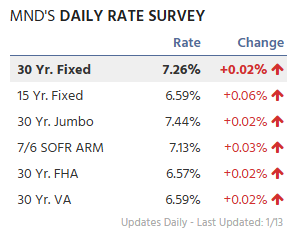

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

USING SELLER CONCESSIONS

TO LOWER YOUR PAYMENT

In 2025, higher interest rates are

raising monthly mortgage payments,

but seller concessions offer a solution.

These incentives, where sellers cover

certain costs or buy down interest

rates, can make homeownership

more affordable.

What Are Seller Concessions?

Seller concessions are contributions

from sellers to reduce buyers’ costs,

such as loan fees, title insurance, or

property taxes. They can also fund

mortgage rate buydowns, lowering

interest rates and monthly payments.

Lower Payments with Rate Buydowns

Seller concessions can finance:

1.Temporary Buydowns: Reduce

the interest rate for the first few

years, e.g., 2% in year one and

1% in year two.

2. Permanent Buydowns: Lower

the rate for the life of the loan,

offering long-term savings.

Expanding Buying Power

Lower monthly payments from

seller-funded buydowns can increase

a buyer’s budget, enabling them

to afford higher-priced homes.

Reducing Upfront Costs

Concessions can also cover

appraisal fees, inspections, and

taxes, reducing the upfront financial

burden on buyers.

Benefits for Both Buyers and Sellers

For buyers, concessions ease

financial strain. For sellers, they

attract more interest and help

close deals faster, even in a high-

rate market. Seller concessions

are a win-win strategy, helping

buyers manage costs and sellers

move properties more efficiently. This

approach makes homeownership more

accessible despite higher interest rates.

JANUARY MARKET REPORT

Here is the audio of Keeping Current

Matters January 2025 Real

Estate Market Report.

If you would like the full video and slide

show, please contact Kalee Taylor at:

kalee@mygreenhomeloans.com

Here are some of the slides

from the Report.

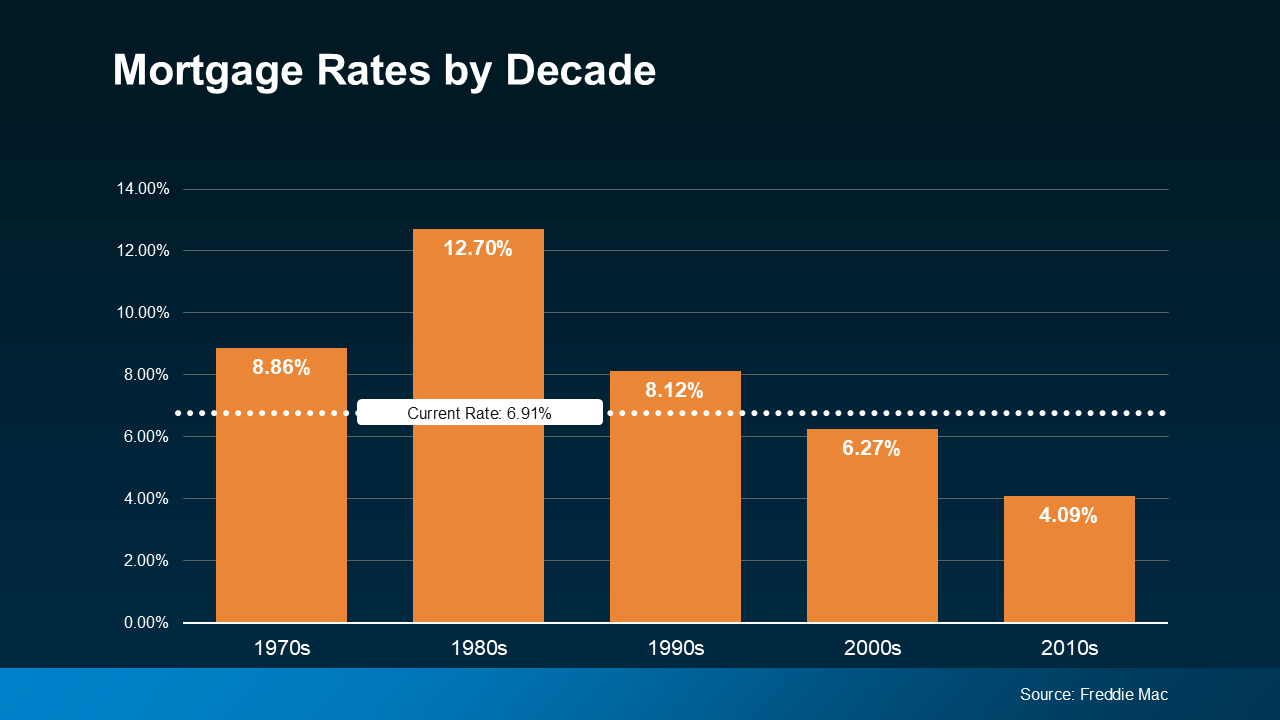

Interest Rates are expected to remain

volatile but many are still forecasting

rates to dip slightly in 2025.

Here is where current interest rates

are today compared to their average

in other decades.

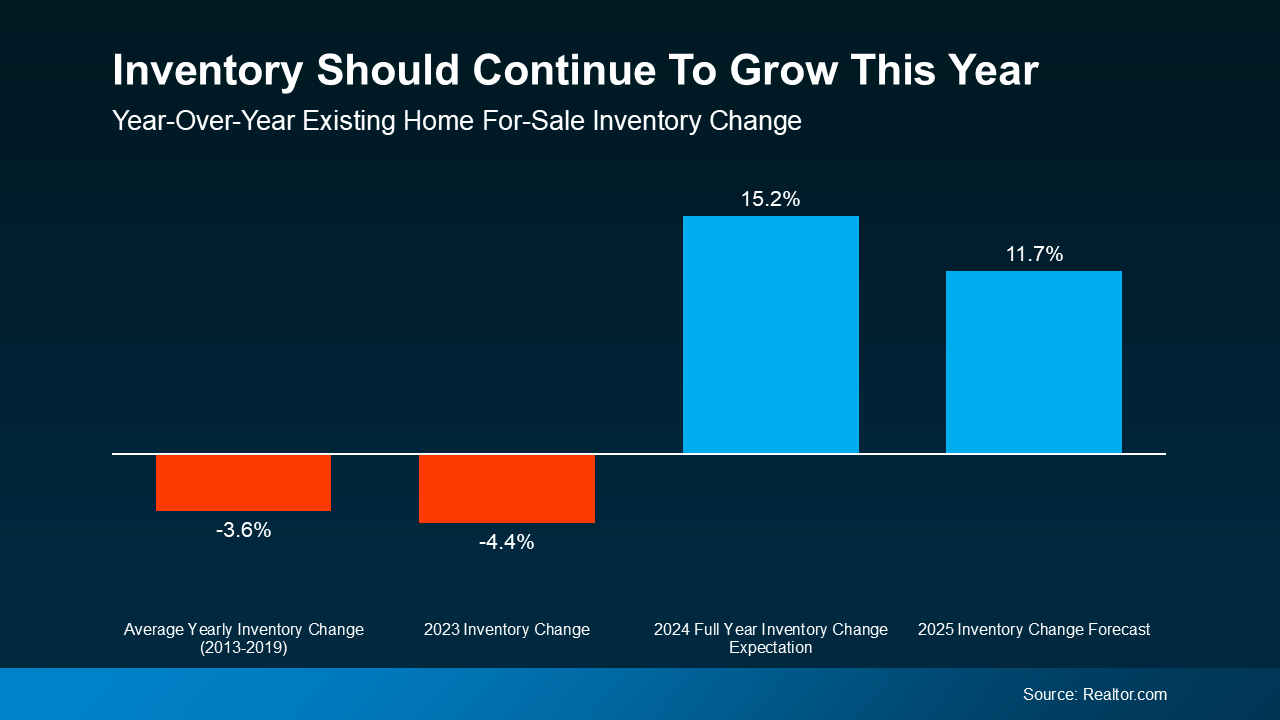

Inventory is expected to continue to

rise giving homebuyers more options

and likely more negotiating power.

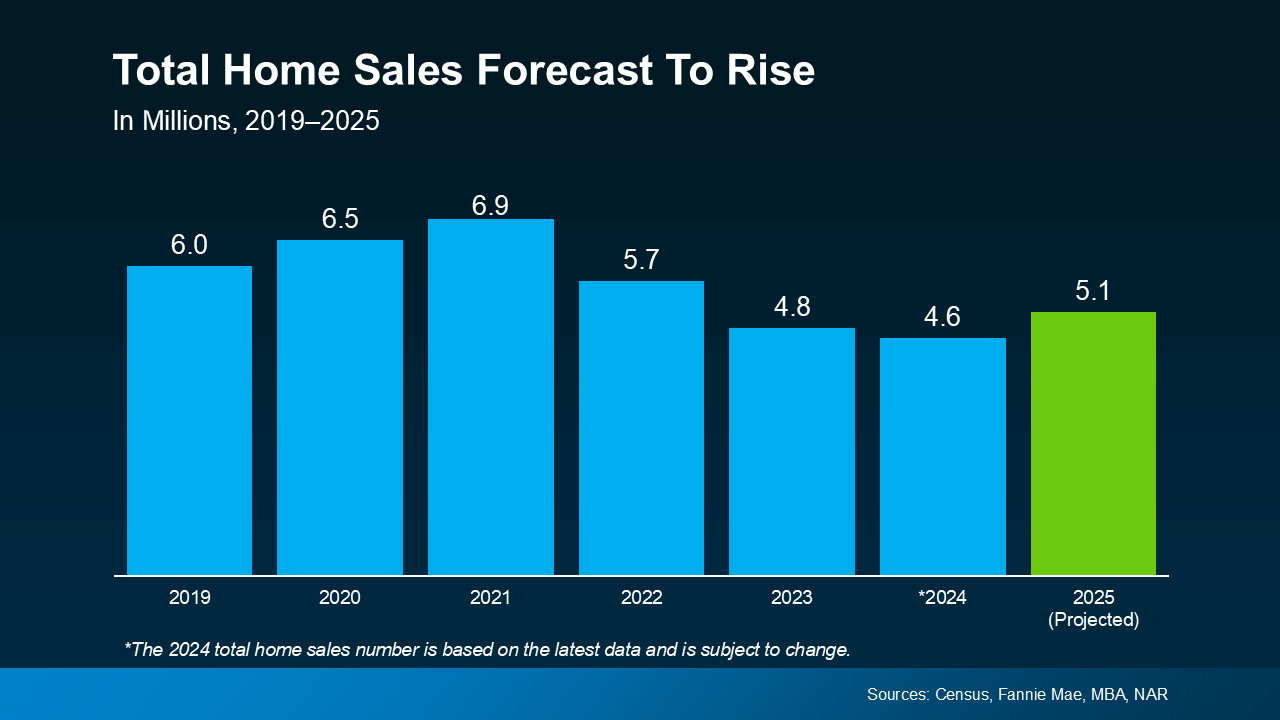

Total Home Sales are also expected

to continue to rise.

Have a great week!!