👨💼 Can the President Force the Fed to Lower Interest Rates?

VIDEO UPDATE:

Video | Facebook

TODAY’S RATES & HOUSING NEWS

Mortgage Interest Rates improved slightly

with the Mortgage Backed Security (MBS)

market trading up +27 bps. The 10 Year

Treasury currently sits at 4.5647%.

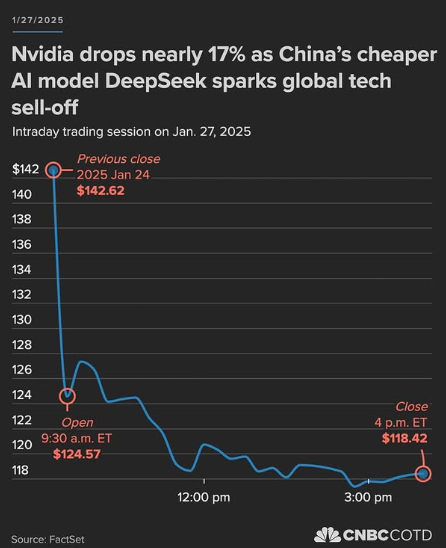

On Monday, interest rates received a

boost when many AI Technology

Company Stocks sold off after DeepSeek,

a Chinese AI startup company, released

a reasoning model that some believe

outperforms Open AI’s latest models.

DeepSeek has claimed that it is making

this technology in a shorter period of

time and at a much lower cost than

their competition. Their technology can

also be used with less expensive chips.

This is sparking concern that many

American companies are not leading the

way on AI Technology development like

originally thought.

When the stock market is going down, many

investor dollars move towards the safety of

bonds which help mortgage interest rates.

This is an important week for Interest Rates.

The FED is meeting this week with a

statement on Wednesday. The market is

not expecting the FED to move the Federal

Funds Rate, but their commentary on the

future movements can cause major shifts

in the market.

On Friday, the PCE Inflation Report could

also be a market mover for interest rates.

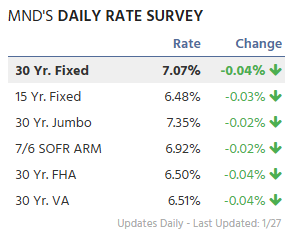

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

CAN THE PRESIDENT FORCE

THE FED TO LOWER

INTEREST RATES?

President Donald Trump has made headlines

by stating his intention to “force” the Federal

Reserve (Fed) to lower interest rates.

“I’ll demand that interest rates drop

immediately,” he told the World Economic

Forum in Davos, Switzerland. “Likewise,

they should be dropping all over the world.

Interest rates should follow us all over.”

“When the oil comes down, it’ll bring

down prices, he said. “Then you won’t

have inflation, and then the interest

rates will come down.” When asked

what he would do if the FED did not

lower rates, Trump stated he would

“put in a strong statement.”

“I think I know interest rates much better

than they do,” he said. “And I think I

know certainly much better than the

one who’s primarily in charge of

making that decision.” “I’m guided by

them very much, ” he added. “But if I

disagree, I will let it be known.”

Does the President have the power

to force the FED to lower rates?

The Fed’s Independence

The answer is no, the President cannot

directly force the Federal Reserve to

lower interest rates.

The Federal Reserve is designed to

be an independent body, meaning

its decisions, including interest rate

changes, are made based on economic

conditions rather than political

pressures. This independence is a

core principle of the central banking

system in the United States, ensuring

that monetary policy decisions are made

objectively, based on economic data,

rather than political motivations.

Legal Framework

The Federal Reserve was created by

Congress in 1913 and is structured to

operate independently from the executive

branch. While the President nominates

the Board of Governors, including the

Fed Chairman, once appointed, these

officials serve fixed terms, with the

Chairman serving a four-year term.

Even if a President disagrees with the

Fed’s policy direction, they cannot remove

or replace the Chairman without just cause,

which is highly unlikely in practice.

The Fed’s Role

The Federal Reserve sets interest rates

to manage inflation, support employment,

and stabilize the economy. These decisions

are made by the Federal Open Market

Committee (FOMC), which meets

regularly to assess economic conditions

and make adjustments as necessary.

The goal is to balance growth with price

stability, which sometimes requires

raising rates to cool down an overheating

economy or lowering them to stimulate

growth during a recession.

Can the President Influence the Fed?

While the President can’t directly control

the Fed’s decisions, they do have influence

in indirect ways. For example, Presidents

can make public statements that might

affect market expectations or appoint

Federal Reserve officials who share

their economic outlook. However, any

pressure to alter the Fed’s course could

undermine the central bank’s credibility,

potentially leading to unintended

economic consequences.

While the President may publicly advocate

for lower interest rates, they cannot

directly force the Federal Reserve to

act. The Fed’s independence is a

cornerstone of U.S. monetary policy,

designed to ensure decisions are made

based on long-term economic health, not

short-term political gain.