TODAY’S RATES & HOUSING NEWS Interest Rates moved up .15% this week with the Mortgage…

🎈Will the Fed Cut Rates by 25 or 50 BPS? What You Need to Know!

VIDEO UPDATE:

Mortgage Interest Rate Update. What Will The FED Do? (youtube.com)

TODAY’S RATES & HOUSING NEWS

Interest Rates improved approximately .1%

with the Mortgage Backed Security (MBS)

market trading up + 25 bps over the past

7 days.

All eyes are on the FED this week –

will they lower the Federal Funds

Rate 25 bps or 50 bps?

The CPI August Inflation report last

week suggested that the FED would

likely cut their Federal Funds Rate

25 bps as inflation numbers came

out close to estimates. Year over

Year inflation came in at 2.5% while

core inflation came in at 3.2%.

On Friday, market expectations started

to change, showing that there could

be a 50 bps rate reduction after

reports and statements came out

from various sources hinting that 50

bps was the likely direction.

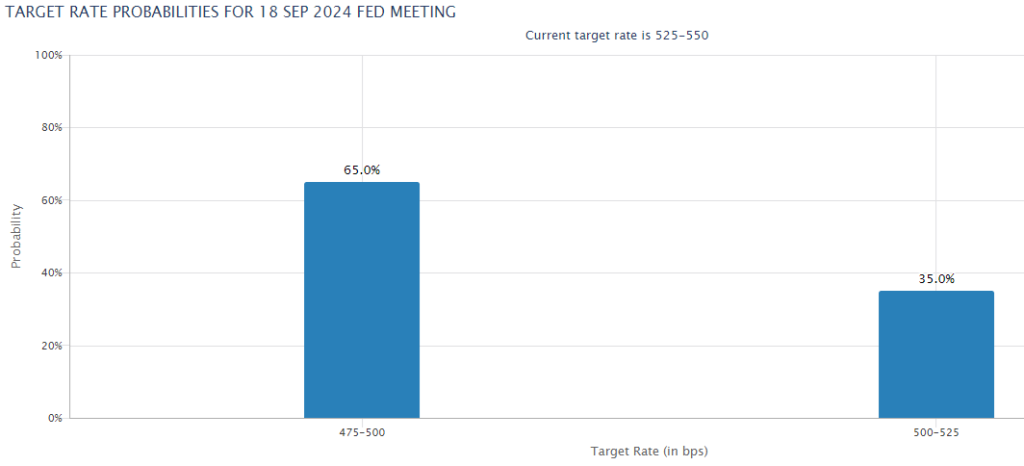

The FED Futures market is predicting

a 65% chance that the FED lowers the

Federal Funds Rate by 50 bps

on Wednesday.

This is very important.

I hear many Realtors tell their clients

that mortgage interest rates will drop on

Wednesday. That is not necessarily true.

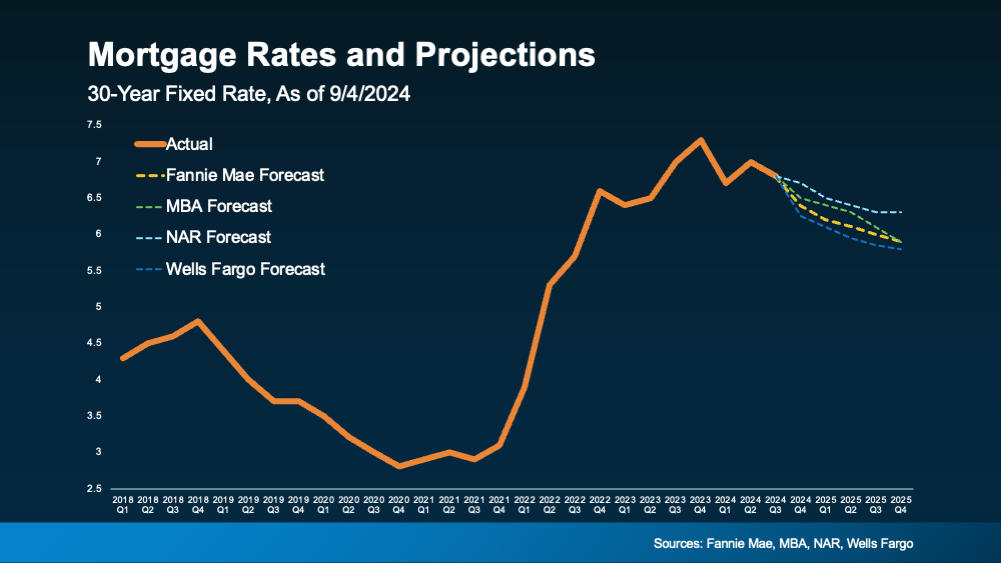

The average 30 Year Fixed Interest

rate on July 1st was 7.14% The

average 30 Year Fixed Interest Rate

today is 6.12%

Interest rates have already dropped

with the expected Federal Funds Rate

drop. They could certainly drop more

based on a 50 bps drop and a statement

implying heavy rate cuts at future

meetings, but interest rates could

also stay relatively the same.

See video below explaining this:

https://www.cnbc.com/video/2024/09/16/the-mortgage-market-is-already-pricing-in-the-feds-easing-cycle-zelman-associates-alan-ratner.html

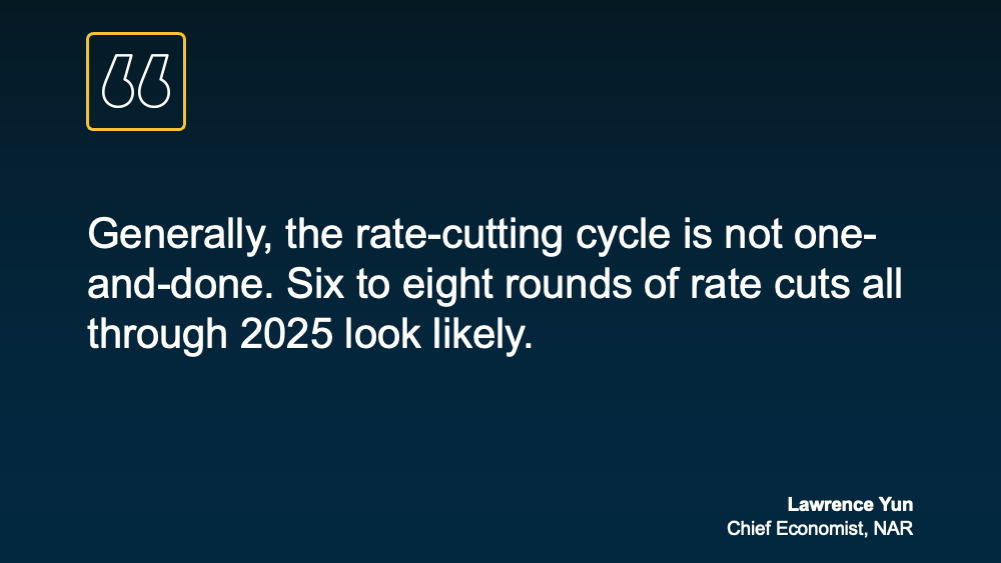

Whatever happens Wednesday, I do expect

mortgage interest rates to gradually decline.

This will likely trigger much higher refinance

activity and more buyer demand for housing.

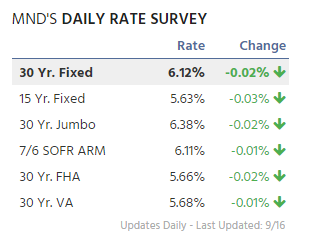

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Etc:

Address of Home:

Estimated Value Of Home:

Current Loan Amount:

Loan Amount You Would Like to Finance:

Current Rate:

Do you know what type of Loan you are Currently in – FHA, VA, etc:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

PURCHASE QUOTE:

What City and State Are You Looking to Buy In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the US Military:

If you are a Veteran, do you get VA Disability:

Thank you!

COULD A REFINANCE BENEFIT YOU?

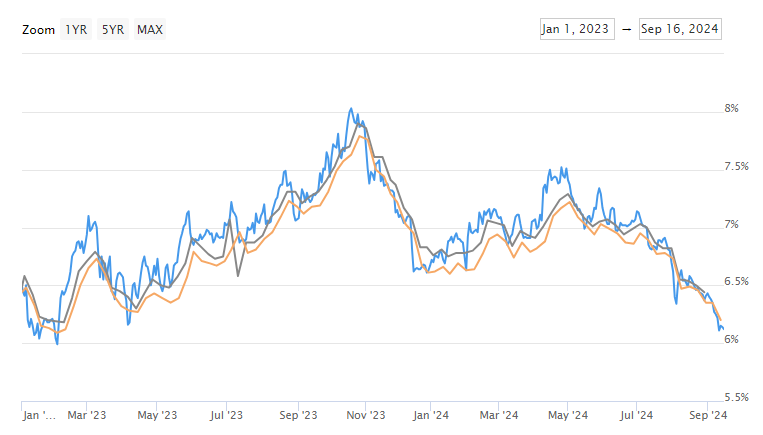

With the average 30 Year Fixed interest

rates at 6.12% today (rates can be lower

than that based on scenario and cost

considerations), when could a rate and

term refinance benefit you?

An easy way to find out if rates were

higher when you completed your last

mortgage is by looking at the average

30-year fixed interest rate chart below.

The Average 30-Year Fixed Interest Rates

popped over 7% in:

March of 2023

June of 2023 – December of 2023

February of 2024 – July of 2024

If you completed your mortgage

during or around these times, it’s a

good idea to assess your situation to

see if a refinance may make sense.

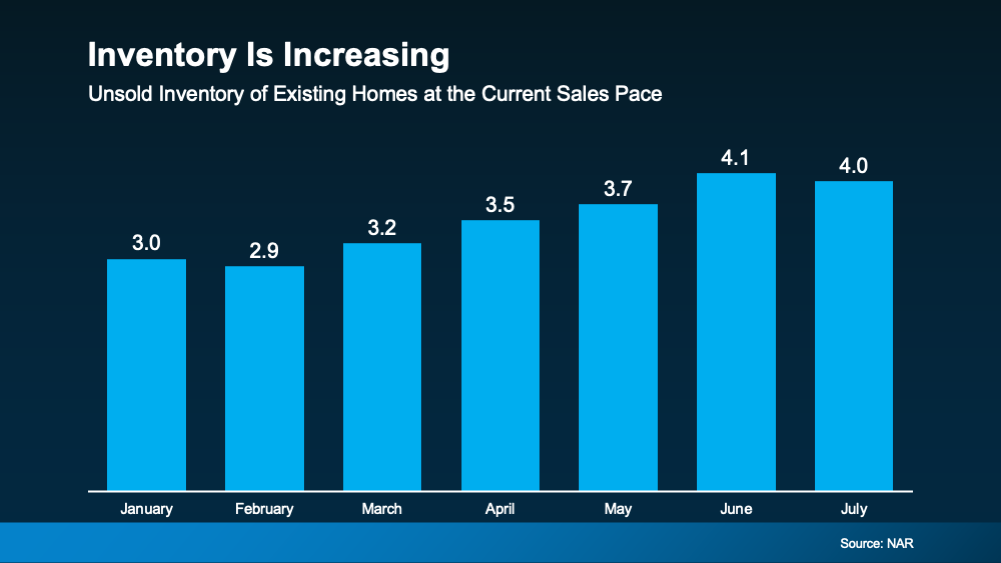

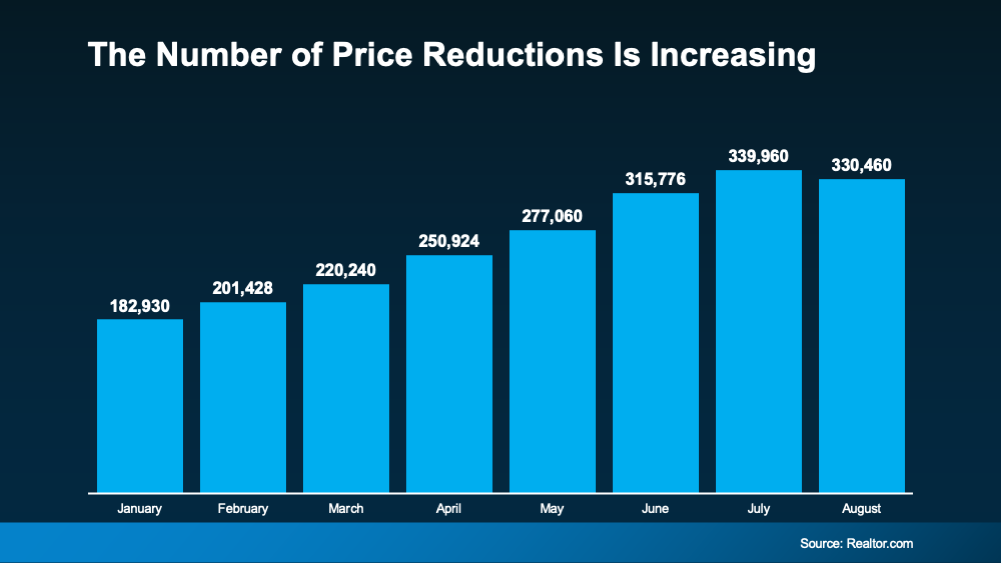

SEPTEMBER 2024 – REAL

ESTATE MARKET REPORT

Here is the audio for Keeping Current

Matters September 2024 Real Estate

Market Report:

Have a great week!