TODAY’S MORTGAGE RATES Mortgage Interest Rates teetered up and down for the week but settled…

📊 Buying a Home? The Next 3 Months Could Save You Thousands

VIDEO UPDATE:

Mortgage Rate Update

TODAY’S MORTGAGE RATES

Mortgage Interest Rates moved slightly

lower on the week with the Mortgage

Backed Security (MBS) market trading

up + 5 bps. 30 Year Fixed Conventional

Average Interest Rates are hovering

in the high 6% to low 7% range.

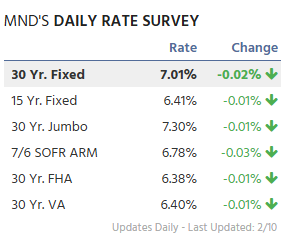

Below are Mortgage News Daily’s

average interest rates across

the country.

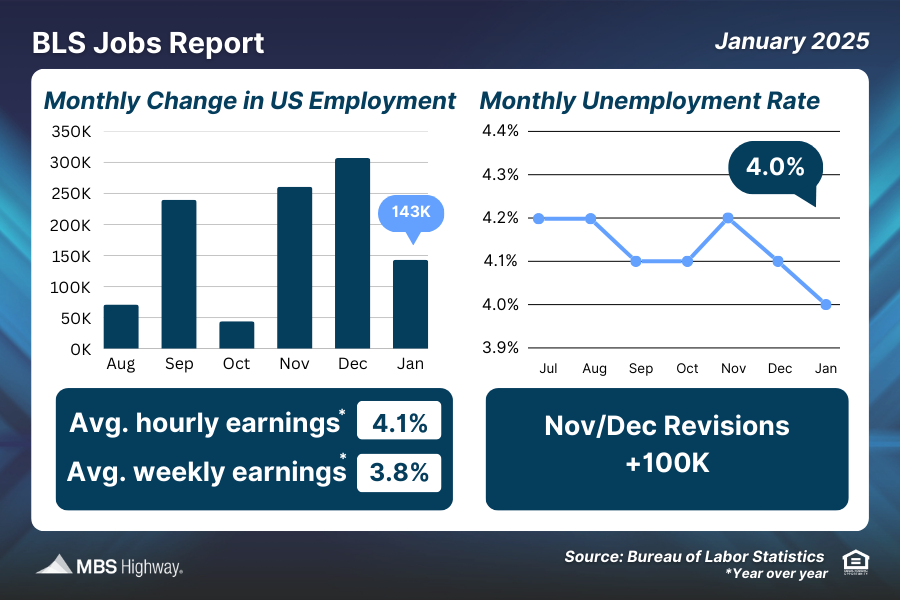

The big news at the end of last week

was Friday’s BLS Jobs Report. Job

creation came in at 143,000, lower

than the expected 170,000 job creation

number. This would usually help interest

rates, but average hourly earnings

went up .5%.

Wages going up is viewed as inflationary

since higher wages means higher

spending power. More demand

increases pricing.

The big news this week is Wednesday’s

CPI inflation report. If the Headline

Inflation Number or Core Inflation

Number comes in lower than expected,

you could see interest rates improve.

There are a lot of characteristics that

go into a mortgage rate – credit score,

investor, loan to value, loan amount,

costs, etc. Please call me to go over

your specific scenario so we can

price your loan out accurately.

Or reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Debt Consolidation:

Address of Home:

Estimated Value of Home:

Current Loan Amount:

Current Rate:

What Type of Loan Are You in Currently – FHA, VA, Conventional:

Estimated Credit Score:

Are You a Veteran or Active Member of the U.S. Military:

If You are a Veteran, Do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State are You Looking to Purchase In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the U.S. Military:

If You are a Veteran, Do you get VA Disability:

Thank you!

MONTHLY MARKET REPORT

Here is Keeping Current Matters

February 2025 Real Estate Market

Report. For the audio, click below:

Here are my favorite slides from

the report.

The average American homeowner has

$311,000 in Home Equity. Much of the

Home Equity and Net Worth has been

created over the past 10 years.

There are a lot of opportunities for

Homeowners to tap into equity to:

Pay off high-interest rate debt

get cash for home improvements

or other investments.

Many Americans feel that renting is not

setting them up for Long Term Financial

Success.

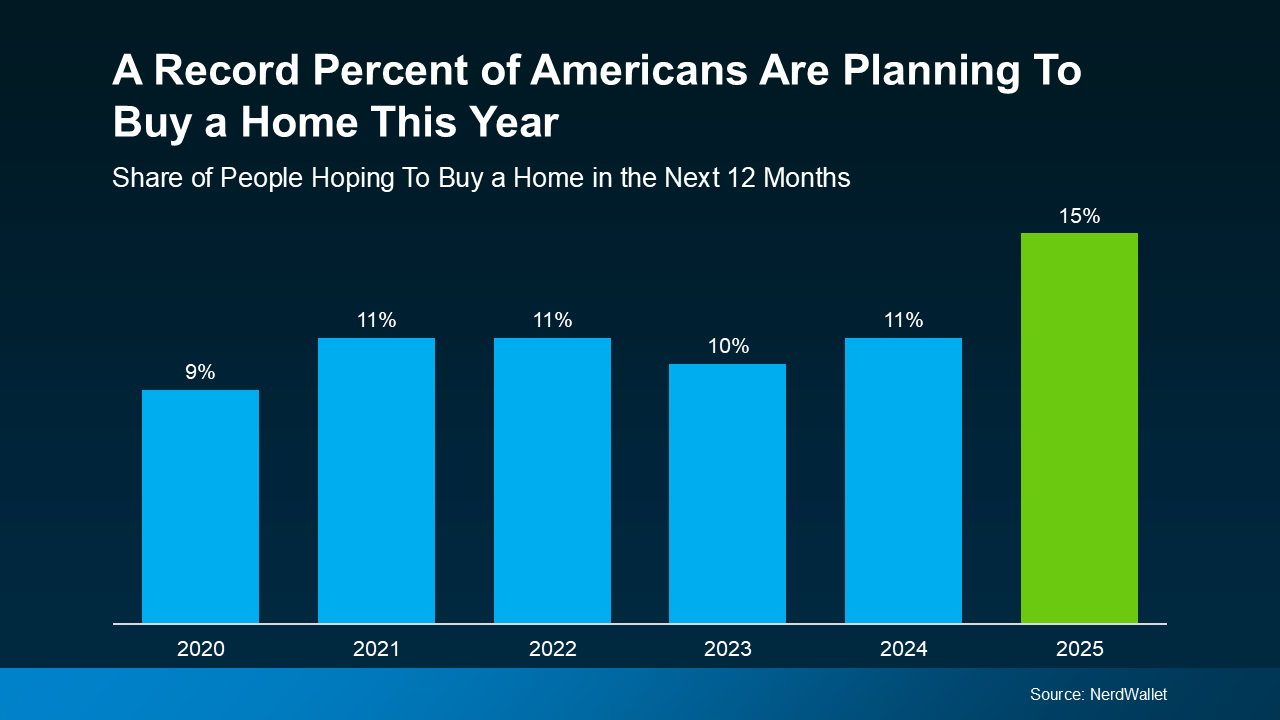

It appears that more Americans are

planning to purchase a home this

year versus the past 5 years.

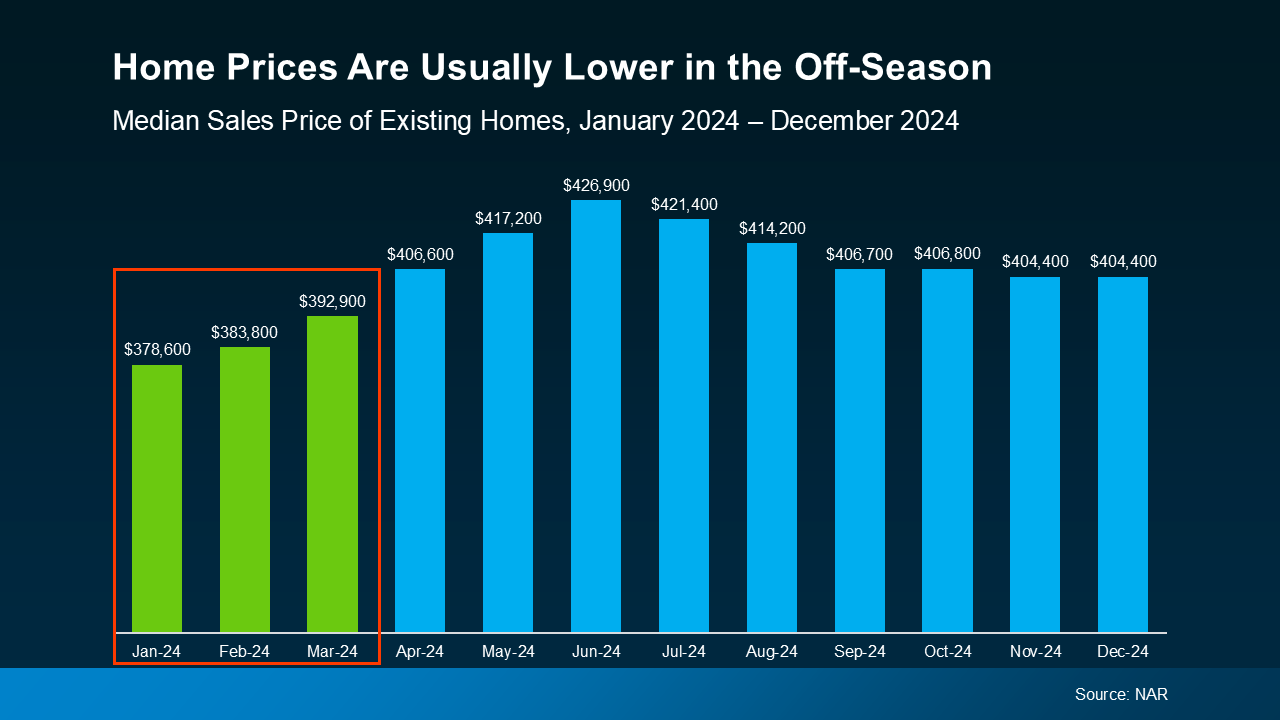

The average purchase price was lower

in 2024 in January through March.

April through October are often peak

demand months which leads to increased

home prices peaking in June.

If you would like to beat the peak

demand months equaling less

competition and usually better purchase

terms, please contact me to get started.

Hope you have a great week!