TODAY’S MORTGAGE RATES Mortgage Interest Rates teetered up and down for the week but settled…

🔮 Fed Hits Pause Button on Rates—Here’s What’s Next

VIDEO UPDATE:

TODAY’S MORTGAGE RATES

Mortgage interest rates stayed the

same over the past 7 days with the

Mortgage Backed Security (MBS)

market trading even over the past

7 days. The 10 Year US Treasury

currently sits at 4.579%.

The lack of rate movement was

surprising with the amount of market

moving events last week.

First, On Wednesday the FED met

and kept the Federal Funds Rate

unchanged. Per Powell, “With our

policy stance significantly less restrictive

than it had been and the economy

remaining strong, we do not need to be

in a hurry to adjust our policy stance.”

It appears the FED is not likely to

lower the Federal Funds Rate for at

least the next couple meetings.

On Friday, the PCE inflation report

came in at expectations. Year over

year inflation rose from 2.4% to

2.6%. And core inflation (stripping

out food and energy) stayed at 2.8%.

The big market mover this week is

Friday’s BLS Jobs Report.

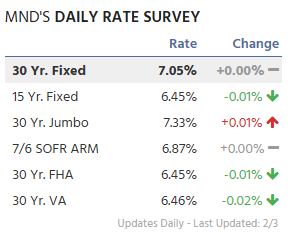

Below are Mortgage News Daily’s

average interest rates across the

country. There are a lot of characteristics

that go into a mortgage rate – credit

score, investor, loan to value, loan

amount, costs, etc.

Please call me to go over your specific

scenario so we can price your loan

out accurately.

OR reply to this email with the answers

to the questions below for Mortgage

Options for your scenario.

REFINANCE QUOTE:

Goal of Refinance – Lower Payment, Cash Out, Debt Consolidation:

Address of Home:

Estimated Value of Home:

Current Loan Amount:

Current Rate:

What Type of Loan Are You in Currently – FHA, VA, Conventional:

Estimated Credit Score:

Are You a Veteran or Active Member of the U.S. Military:

If You are a Veteran, Do you get VA Disability:

HOME PURCHASE QUOTE:

What City and State are You Looking to Purchase In:

Estimated Purchase Price:

Loan Amount You Would Like to Finance:

Will Property be a Primary Residence, Investment Property, or Vacation Home:

Estimated Credit Score:

Are You a Veteran or Active Member of the U.S. Military:

If You are a Veteran, Do you get VA Disability:

Thank you!

NATIONAL HOME PRICES RISE 3.8%

The S&P Case Shiller Home Price

Index was released last week. The

report has a 3-month lag so all

numbers are for November 2024.

In November 2024, the S&P CoreLogic

Case-Shiller National Home Price Index

reported a 3.8% year-over-year

increase, up from October’s 3.6% rise.

This growth was primarily driven by

significant price gains in major metropolitan

areas, with New York City leading at a 7.3%

annual increase, followed by Chicago and

Washington, D.C., at 6.2% and 5.9%

respectively. Conversely, Tampa, Florida,

experienced a 0.4% decline, marking the

first annual drop in a major Florida

market in over a year.

Forecasts for 2025 predict national home

price gains between 1.3% and 3.5%, with

mortgage rates remaining in the

6% – 7% range.

Here is the home value appreciation

for each city in the 20-city index over

the past year.

1. New York +7.3%

2. Chicago +6.2%

3. Washington +5.9%

4. Las Vegas +5.6%

5. Cleveland +5.4%

6. Seattle +5.4%

7. Boston +5.1%

8. Detroit +4.6%

9. San Diego +4.5%

10. Los Angeles +3.8%

11. Charlotte +3.6%

12. Miami +3.2%

13. Atlanta +2.9%

14. Minneapolis +2.7%

15. Portland +2.0%

16. San Francisco +1.9%

17. Phoenix +1.6%

18. Dallas +1.0%

19. Denver +.09%

20. Tampa -0.4%

Hope you have a great week!